Imagine a world without accounting: businesses in disarray, financial transactions untracked, and economic chaos reigning supreme. Without the meticulous work of accountants, companies would struggle to maintain order, plan for the future, and comply with regulations. This is why the field of accounting is indispensable, providing the structure and accuracy necessary for financial stability and growth.

Pursuing a career in accounting is not only rewarding due to its critical role in the economy, but it also offers a plethora of career opportunities, from public and private accounting to specialized fields like forensic and environmental accounting. So, keep reading to learn more about the different types of accountants and what they do.

What Is an Accountant?

An accountant is an expert in accounting or accountancy responsible for managing financial records as well as ensuring accuracy and compliance with legal and regulatory requirements. Their expertise extends beyond basic bookkeeping to encompass various financial activities, including auditing, tax preparation, financial planning, and consulting.

These professionals use their accounting skills to help organizations maximize profitability, ensure efficient use of resources, and achieve long-term financial stability. They work in various industries, including public accounting firms, corporations, government agencies, and non-profit organizations.

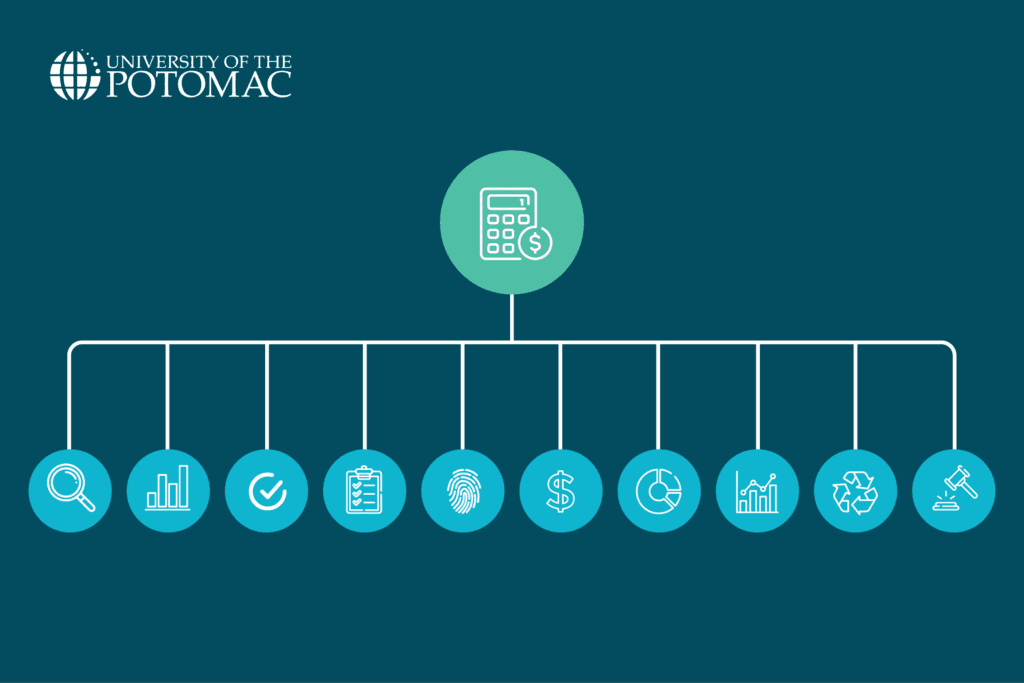

10 Types of Accountants

Accounting is a broad field with various specializations, each dedicated to specific aspects of financial management and reporting. Understanding these different types of accountants is essential for grasping the full scope of the profession. Below, we will explore ten distinct types of accountants, each with unique roles and responsibilities that cater to various needs within the financial field.

1. Public accountants

Public accountants offer clients a wide range of accounting services, including auditing, tax preparation, and consulting. They typically work for public accounting firms and provide services to businesses, government agencies, non-profits, and individuals. Public accountants often specialize in areas such as tax planning, forensic accounting, or advisory services.

Public accountants are recognized for their objectivity and independence, essential traits that distinguish their role from private accountants. This independence allows them to conduct unbiased audits and ensure the accuracy of financial statements, which is crucial for regulatory compliance and trustworthy financial reporting. In contrast, private accountants are employed by a single organization and focus on managing internal financial matters. Therefore, when considering public vs. private accounting, these differences in objectivity and independence highlight the responsibilities and contributions of each sector.

2. Management accountants

Management accountants, also known as cost or managerial accountants, focus on internal financial management within an organization. They prepare detailed financial reports, budgets, and forecasts to assist management in decision-making and strategic planning. These accountants analyze financial data to identify trends, variances, and opportunities for cost savings and efficiency improvements.

These professionals are important in setting financial goals, evaluating performance, and developing strategies to achieve organizational objectives. They often collaborate with other departments to provide financial insights and support operational initiatives. Management accounting, in general, ensures that resources are allocated effectively and that the organization remains financially healthy.

3. Government accountants

Government accountants work within public sector organizations, including federal, state, and local government agencies. Their primary responsibility is to ensure these institutions use public funds properly and comply with laws and regulations. Government accountants prepare financial reports, manage budgets, and conduct audits to assess the financial performance of government programs and operations.

These accountants must thoroughly understand government accounting standards and practices, which differ from those in the private sector. Government accountants play a vital role in maintaining transparency and accountability in using taxpayer money, and their work supports the efficient functioning of public services and programs.

4. Internal auditors

Internal auditors evaluate an organization’s internal controls, risk management processes, and governance practices. They perform audits to assess the effectiveness of financial and operational procedures, identify areas of improvement, and ensure compliance with laws and regulations. Internal auditors provide recommendations to enhance efficiency, reduce risks, and safeguard assets.

Internal auditors work independently from the organization’s management to maintain objectivity and impartiality. Their role is crucial in preventing fraud, detecting errors, and ensuring the organization operates under its policies and objectives. Internal auditors often collaborate with external auditors and regulatory bodies to address financial issues and implement corrective actions.

5. Forensic accountants

Forensic accountants specialize in investigating financial fraud, embezzlement, and other financial crimes. They often work with law enforcement agencies, legal teams, and insurance companies to uncover financial misconduct and support litigation.

These accountants must be detail-oriented, analytical, and knowledgeable about legal procedures and regulations. Their work involves reconstructing financial data, interviewing witnesses, and presenting findings in court. Forensic accountants play a critical role in resolving financial disputes, recovering assets, and ensuring justice in cases of financial wrongdoing.

6. Tax accountants

Tax accountants specialize in tax planning, preparation, and compliance for individuals and organizations. They prepare tax returns, identify tax-saving opportunities, and represent clients in dealings with tax authorities.

Tax accountants must have a thorough understanding of tax codes, deductions, credits, and exemptions. They help clients navigate complex tax issues, avoid penalties, and optimize their financial situation. During tax season, tax accountants are particularly busy, ensuring that clients meet filing deadlines and comply with all tax obligations.

7. Project accountants

Project accountants focus on the financial management of specific projects within an organization. They monitor project budgets, track expenses, and ensure that financial goals are met. Project accountants work closely with project managers to provide financial insights, forecast costs, and report on project performance.

Project accountants must be adept at handling multiple tasks and managing financial data for various projects simultaneously. Their work ensures that projects are completed within budget and on time, contributing to the overall success of the organization. Project accountants play a key role in project planning, execution, and post-project analysis.

8. Investment accountants

Investment accountants manage financial assets and investment portfolios for individuals, businesses, and financial institutions. They ensure accurate accounting for investment transactions, including stocks, bonds, mutual funds, and other securities. Investment accountants prepare financial reports, analyze investment performance, and provide insights into market trends.

These accountants must have a strong understanding of financial markets, investment strategies, and regulatory requirements. Investment accountants help clients make informed decisions about their investments, optimize returns, and manage risks. Their work supports the growth and stability of investment portfolios and contributes to long-term financial planning.

9. Environmental accountants

Environmental accountants, also known as green accountants, focus on the financial impact of environmental policies and practices. They analyze the costs and benefits of sustainability initiatives, including reducing carbon emissions, conserving resources, and complying with environmental regulations. Environmental accountants help organizations measure their environmental footprint and develop strategies to improve sustainability.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

Environmental accountants must be knowledgeable about environmental laws, regulations, and industry standards. They provide valuable insights into the financial impacts of environmental decisions, helping organizations balance profitability with ecological responsibility. Their work supports the development of sustainable business practices and promotes corporate social responsibility.

10. Fiduciary accountants

Fiduciary accountants manage financial affairs on behalf of individuals or organizations, often in a fiduciary capacity. This includes managing trusts, estates, and guardianships, as well as acting as financial advisors or executors. Fiduciary accountants ensure that financial transactions are conducted in the best interests of their clients and comply with legal and ethical standards.

Fiduciary accountants must possess a high level of integrity, professionalism, and expertise in trust and estate law. They manage tasks such as preparing financial statements, managing investments, and distributing assets according to legal requirements and client wishes. Fiduciary accountants play a crucial role in protecting and managing assets, ensuring that clients’ financial goals are achieved.

Challenges and Rewards

Accountants across various fields face common challenges that test their skills and adaptability. One significant challenge is staying current with constantly changing regulations and standards. For instance, public accountants must frequently update their knowledge of tax laws and auditing standards to ensure compliance and provide accurate advice. Similarly, private accountants face the challenge of managing internal controls and financial reporting in an ever-evolving business environment. The increasing reliance on technology also presents a dual challenge: accountants must be proficient with advanced software and stay vigilant against cybersecurity threats that could compromise financial data.

Despite these challenges, pursuing a career in accounting offers numerous benefits and rewards. Accountants enjoy high job security, as their expertise is consistently in demand across various industries. The demand for accountants is expected to grow by 4% from 2022 to 2032, with around 126,500 job openings each year. Furthermore, accountants typically receive competitive salaries and benefits that reflect their value to organizations. The median annual salary for accountants is $79,880, with the top 10 percent earning over $137,280 per year.

Beyond financial rewards, many accountants find satisfaction in their ability to provide critical insights that drive business decisions, contribute to financial stability, and uphold ethical standards in financial reporting. Moreover, the diverse career opportunities in accounting allow professionals to choose paths that align with their interests and strengths. This flexibility, combined with the potential for continuous learning and professional growth, makes accounting a highly attractive career choice for those passionate about numbers and problem-solving.

The Bottom Line

In conclusion, accounting serves as the foundation of financial stability and transparency, playing an essential role in ensuring that businesses and economies function smoothly. All the different types of accountants contribute uniquely to maintaining this order. Without their expertise, many people and businesses would face significant challenges, highlighting the indispensable nature of this profession.

If you’re considering a career that offers stability, diverse opportunities, and the chance to make a meaningful impact, pursuing an accounting degree is a wise choice. Prepare yourself for any of the exciting careers we’ve highlighted, and step into a field that keeps the business world running seamlessly. So, join Potomac, embrace the world of numbers, become the hero behind the scenes, and make a difference with your skills and knowledge.

Frequently Asked Questions

What are the three most common types of accountants?

The three predominant types of accountants are:

- Public accountants;

- Management accountants;

- Government accountants.

Is accounting a good career?

Yes, accounting is a good career due to its high demand, job security, and the potential for competitive salaries.

What skills do you need for an accountant?

Accountants need strong analytical skills, attention to detail, proficiency with accounting software, and good communication abilities.

Who should be an accountant?

Individuals who excel in working with numbers, have strong analytical and organizational skills, and possess a keen eye for detail should consider becoming an accountant.

Is accounting a stressful job?

Accounting can be stressful, especially during peak periods like tax season or year-end audits. However, effective time management and organizational skills can help mitigate stress.