Key Takeaways

- Accounting has a 6% annual job growth rate, with salaries ranging from $34,000 to $108,500 depending on experience.

- There are various career advancement opportunities, from entry-level positions to senior leadership roles such as accounting manager, finance director, or even CFO.

- Success in accounting starts with a bachelor’s degree, certifications like CPA, staying current on trends, and gaining diverse experience.

- To maximize the benefits of being an accountant, you need to actively seek professional development and networking.

They say that behind every good business is a great accountant. Well, that’s true in most cases, as no business runs on ambition and creativity alone. These can spark innovation, but without the financial clarity and precision to back them up, realistically, you can’t implement those ideas effectively or expect to sustain them over time.

Accounting isn’t just what keeps businesses running smoothly—it’s also an excellent career option for people who thrive on trying to find stability in a world full of uncertainty. The benefits of being an accountant go beyond the numbers.

What Does an Accountant Do?

Accountants manage client finances and are responsible for documenting, analyzing, and ensuring the accuracy of financial records. Their aim is to make sure that their clients, whether individuals or companies, meet their financial obligations and adhere to regulations.

There are many types of accountants, and their work spans various areas. However, some of their most common duties include:

- Collaborating with external and internal auditors to verify that financial records comply with standards and regulations

- Preparing and reviewing revenue, payroll, spending, and financial plans

- Preparing profit and loss reports

- Analyzing financial data, including expenditure and revenue trends

- Establishing and implementing rules and guidelines relevant to financial processes

- Keeping financial records organized and up-to-date

In addition to these everyday tasks, accountants are often responsible for providing strategic advice, supporting financial decision-making, and preparing tax returns. Their expertise enables individuals and businesses to overcome challenges related to finance.

Benefits of Being an Accountant

There are many reasons why people choose to pursue the work of an accountant. For some, it may be because of a genuine interest in the discipline’s logic and structure. In other cases, people might be inclined to this job because of its many benefits.

These benefits of becoming an accountant include the following:

Diverse career pathways

Accounting skills like financial acumen, attention to detail, problem-solving, and data analysis are highly transferable to many other finance-related positions. This versatility allows accountants to explore a range of job titles and functions, such as:

- Staff accountant

- Investment accountant

- Certified public accountant

- Cost accountant

- Forensic accountant

- Management accountant

- Project accountant

- Auditor

- Financial consultant

- Financial advisor

Job security and demand

Another benefit of becoming an accountant is the high level of job security and the growing demand for these professionals. The employment of accountants and auditors is projected to grow by 6% from 2023 to 2033. This percentage is faster than the average for all occupations, as approximately 130,800 new accounting positions will open annually over the next decade.

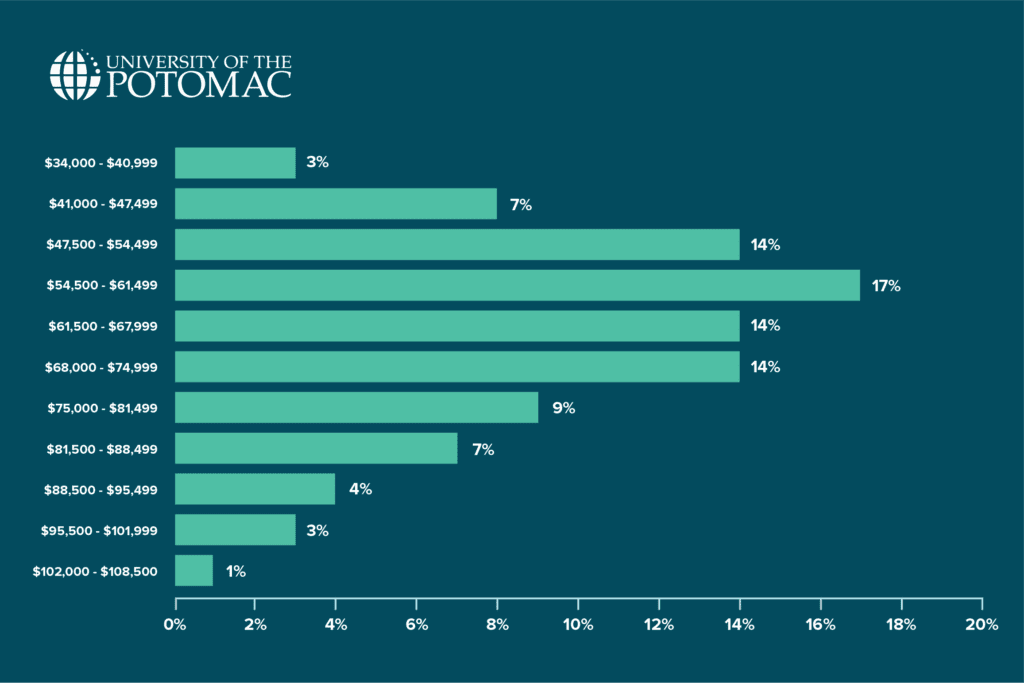

Competitive salary

Accounting is also an attractive career option because of its competitive salary potential. The average annual salary for an accountant in the United States is approximately $68,326, though this figure can range from $34,000 for those just starting out to $108,500 per year for top earners.

This financial compensation is often reflective of an accountant’s experience, education, certifications, and area of specialization. Even with this variability, salaries in accounting make it a lucrative choice for those interested in the field.

Opportunities for career advancement

Accounting also offers abundant opportunities for career advancement through a clear career progression path, from entry-level positions to senior leadership roles such as accounting manager, finance director, or even chief financial officer (CFO). Advancement, like in most fields, depends on gaining experience, earning certifications, or pursuing further education, such as a Master of Business Administration (MBA) or a master’s degree in accounting.

Accountants may also move into specialized areas like tax accounting, forensic accounting, or auditing, each of which can lead to more senior roles with increased responsibility and higher earning potential. Leadership positions, such as becoming a partner at a public accounting firm or a high-level financial role in a corporation, are also realistic goals for accountants who gain significant experience and demonstrate their value.

Work flexibility

Accounting work is often associated with precision, but that doesn’t mean the career itself lacks flexibility. Accountants enjoy a wide range of flexible work options. Many can set their own hours, particularly those in roles like tax preparation or freelance accounting. The traditional image of an accountant sitting in an office all day is changing as the growing trend of remote work has brought more flexibility to the field.

Many firms offer virtual accounting services or have moved to remote work structures, allowing accountants to balance their personal and professional lives. Furthermore, those who wish to work independently have the option to start their own practice or consulting business, which provides even greater flexibility in their career.

Opportunities to travel

Many people mistakenly think that accounting is all about crunching numbers and performing repetitive tasks. In reality, accounting roles are often far more dynamic, especially in certain positions that offer travel opportunities. Accountants in auditing, consulting, or international tax roles may be required to travel to different cities or even countries to meet clients or oversee projects.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

Travel offers exposure to different industries, cultures, and financial systems, enriching an accountant’s professional experience. For accountants who enjoy variety and adventure, such roles can make their work experience far more engaging and rewarding than a typical desk job.

How to Maximize the Benefits of Being an Accountant

To truly capitalize on all the benefits that come with being an accountant, you need to actively seek professional development and networking. You can do so by:

Pursuing professional certifications

Certifications, in any field, are one of the most impactful ways to enhance your career by improving your expertise. For accountants, some useful options include:

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Certified Management Accountant (CMA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

Staying updated

With the occasional changes in tax laws, financial regulations, and technology, it’s important to keep up with transformations and trends. Continuous learning through online courses, webinars, and virtual summits will help you remain competitive.

Building connections

Networking is a must if you intend to grow in any profession, and accounting is no exception. Membership in groups like AICPA (American Institute of Certified Public Accountants) or local accounting associations connects you with industry peers and mentors.

Industry events are also goldmines for networking and learning. They help you gain insights into the latest industry practices and provide opportunities to meet potential employers or collaborators.

Diversifying your experience

You should seek to expand your expertise beyond traditional accounting, as this will help you stand out in the competitive job market. So, explore fields like forensic accounting, financial planning, or sustainability reporting.

You could also volunteer for cross-departmental projects to gain insights into operations, marketing, or HR functions.

Keeping a healthy work-life balance

To truly maximize and enjoy the benefits of your career, you must maintain a healthy work-life balance. Try to set clear boundaries between work and personal time and, when needed, take breaks and prioritize self-care in order to avoid burnout.

The Bottom Line

Before you can enjoy the rewards of an accounting career, you need to put in the work and invest in yourself by earning a degree in accounting. Potomac’s Bachelor of Science in Accounting program is an excellent choice, designed to equip you with practical skills and a competitive edge for public, private, or government accounting roles.

In the world of accounting, success is earned through preparation and hard work—because, like numbers, the benefits of this career always add up.

Frequently Asked Questions (FAQs)

What qualifications do I need to become an accountant?

To become an accountant, you need to earn a bachelor’s degree in accounting or a related field, along with obtaining strong analytical and organizational skills. Then, professional certifications, such as a CPA, can enhance career prospects.

How long does it take to become a certified accountant?

Becoming a certified accountant typically takes 4-5 years, including earning a bachelor’s degree and passing certification exams, such as the CPA exam.