- Becoming a CPA opens up high-paying career opportunities with job stability and growth potential.

- The process includes meeting educational requirements, gaining experience, passing the exam, and maintaining licensure.

- CPAs are highly valued across various industries, offering a wide range of career paths in accounting and finance.

Have you ever wondered how to become a Certified Public Accountant? It’s more than just crunching numbers – it’s about mastering the financial world and becoming a trusted advisor. Whether you’re dreaming of guiding businesses through tax season or helping individuals with their finances, becoming a CPA is a career that offers plenty of rewards.

With a CPA license, you’re not just an accountant; you’re a financial expert with a key role in the success of companies and organizations. In this blog post, we’ll walk you through the steps to earn this prestigious certification and unlock the doors to an exciting career!

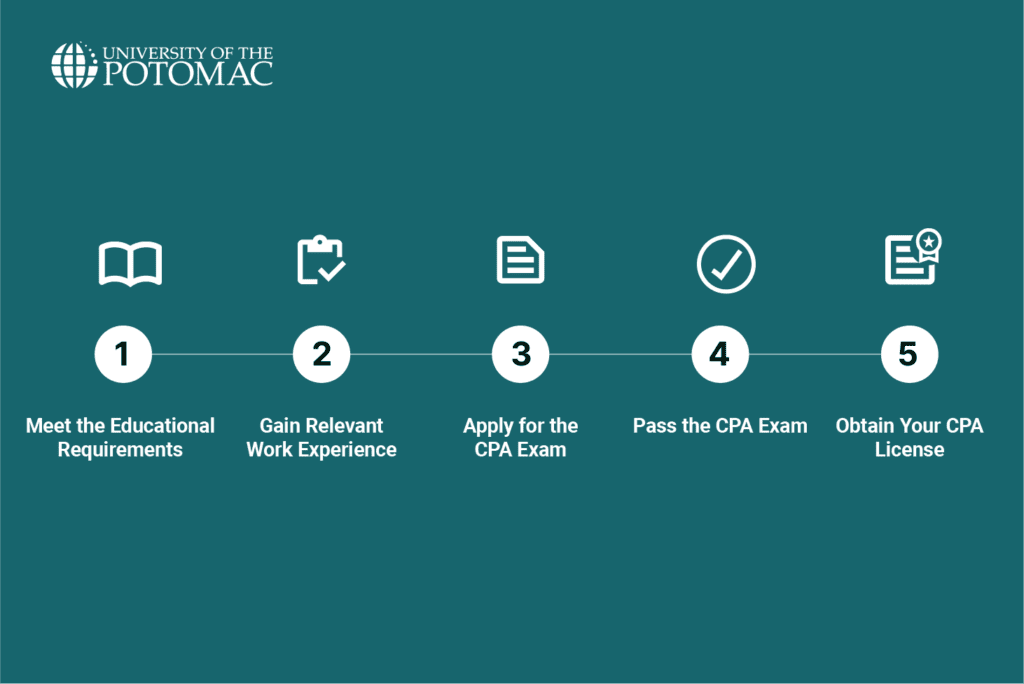

Steps to Becoming a Certified Public Accountant

Becoming a CPA involves meeting education and experience requirements, passing the CPA exam, and obtaining licensure. While the process is challenging, the career rewards make it worthwhile.

Meet the educational requirements

Becoming a Certified Public Accountant starts with meeting specific educational requirements. Each state has its own guidelines, but most follow a standard set of expectations.

Here’s what you’ll need:

- A bachelor’s degree in accounting, finance, or a related field.

- 150 credit hours of college coursework (though some states allow candidates to sit for the CPA exam with 120 credit hours, they still require 150 for full licensure).

- Additional education may be necessary to reach the 150-hour requirement. This can be achieved through:

- A master’s degree in accounting or a related field

- Extra undergraduate or graduate-level coursework

- An accelerated or combined bachelor’s/master’s program

Since a standard bachelor’s degree typically covers only 120 credit hours, many students take additional classes at a university, community college, or online program to bridge the gap. It’s important to check your state’s specific rules to ensure you’re on the right track.

Gain relevant work experience

Meeting the education requirements is just the first step – next, you’ll need hands-on experience. Most states require 1 to 2 years of relevant accounting work before granting a CPA license. This experience must be supervised by a licensed CPA in good standing, ensuring you gain the necessary skills under expert guidance.

To gain relevant experience, try one of the following:

- Public accounting firms – Work in audit, tax, or advisory services for a broad exposure to different industries and clients.

- Corporate accounting and finance – Take on roles in financial reporting, internal auditing, or managerial accounting within private companies.

- Government or nonprofit organizations – Gain experience in budgeting, grant accounting, and regulatory compliance.

The best path depends on your career goals. For example, if you’re aiming for a career in auditing, public accounting may be ideal. If you prefer financial management, a corporate setting might be a better fit.

Regardless of your chosen path, ensure your experience meets your state’s CPA licensure requirements.

Apply for the CPA exam

Once you’ve met the education and experience requirements, the next step is applying for the CPA exam. To do so:

- Confirm eligibility before applying – Check with your state board of accountancy to ensure you meet the education and experience requirements.

- Gather required documents – You’ll typically need:

- Official college transcripts

- Personal identification (e.g., driver’s license or passport)

- The CPA exam application form from your state board of accountancy

- Submit the CPA exam application – Apply through your state board of accountancy or the National Association of State Boards of Accountancy (NASBA).

- Pay the application fee (varies by state, typically $50–$200).

- Wait for your application to be processed (usually 4 to 6 weeks).

- Receive the notice to schedule (NTS) – Once approved, you’ll get an NTS, which allows you to schedule your exam sections.

- Schedule the CPA exam – Use your NTS to book your exam date through Prometric, the official testing provider.

Applying early is crucial since processing times can delay your ability to sit for the exam. Plan accordingly to stay on track with your CPA journey.

Pass the CPA exam

The CPA exam is a pivotal step toward certification. Developed by the American Institute of Certified Public Accountants (AICPA) and administered by NASBA and Prometric, the exam is designed to test your knowledge across key areas of accounting.

It consists of four sections:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

You must pass all four sections within an 18-month rolling window, meaning once you pass your first section, the clock starts ticking. If you don’t pass all sections within this timeframe, your oldest passing score will expire, and you’ll have to retake that section.

Obtain your CPA license

Passing the CPA exam is a major milestone, but you’re not officially a CPA yet. To gain full licensure, you’ll need to complete a few final steps.

Here’s what comes next:

- Submit a CPA licensure application – Each state has its own process, but generally, you’ll need to:

- Complete and submit the licensure application through your state board of accountancy.

- Provide required documents, including proof of passing the CPA exam and verification of your work experience.

- Pay the application fee (varies by state).

- Wait for licensure approval & receive your CPA certificate – Once your application is reviewed and approved, you’ll receive your official CPA certificate, allowing you to legally practice as a CPA. Processing times vary by state.

- Maintain your CPA license – Earning your CPA license isn’t the end of the journey. To keep it active, you must complete Continuing Professional Education (CPE) requirements, which typically require ongoing coursework to stay up to date with industry standards.

With your CPA license in hand, you’re now fully equipped to advance in your accounting career.

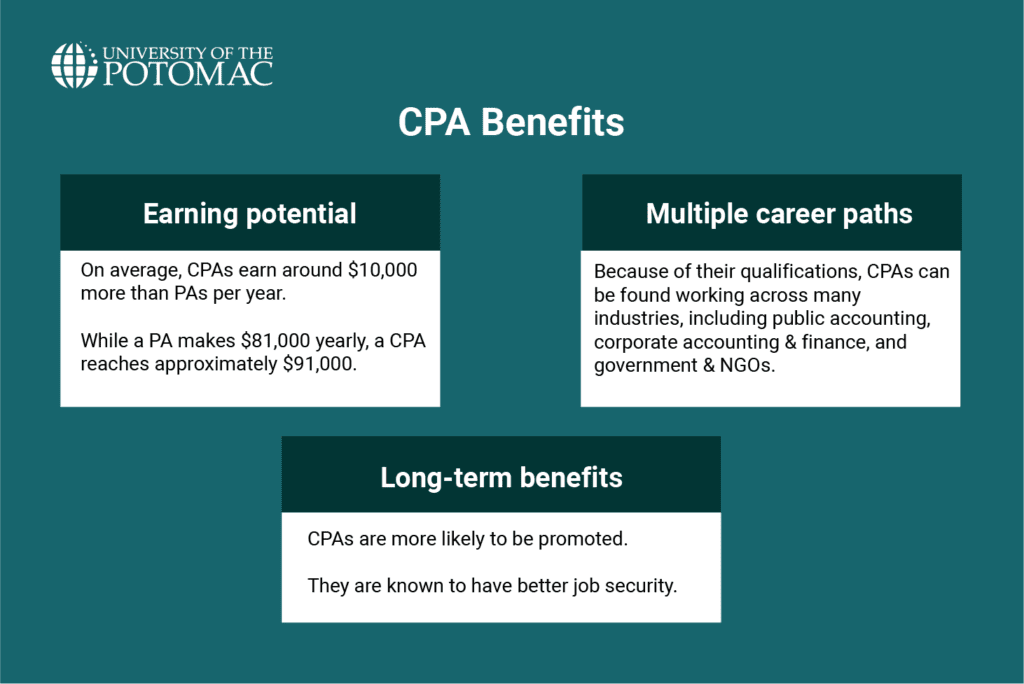

Why Become a CPA?

Becoming a CPA offers career stability, higher earning potential, and opportunities for advancement in various industries, making it a highly rewarding and respected credential in the accounting field.

Earning potential

Becoming a CPA can significantly impact your earning potential. That’s why many PAs seek certification, since the more qualified an accountant is, the higher the salary. On average, CPAs earn approximately $91,000 annually, while non-CPA accountants earn around $81,000 per year.

However, several other factors influence the salary for CPAs, including:

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

- Experience: CPAs with more years in the field typically command higher salaries due to their expertise and proven track record.

- Location: Salaries can vary based on geographic location, with urban areas often offering higher compensation to account for the cost of living.

- Industry: Certain sectors, such as finance and technology, may offer higher salaries compared to others.

- Education: Advanced degrees or specialized certifications can enhance earning potential.

- Company size: Larger firms may offer higher salaries and more benefits compared to smaller organizations.

While obtaining a CPA license is a significant factor in the salary compared to non-CPAs, these additional elements also play a crucial role in determining an accountant’s earnings.

Multiple career paths

Becoming a CPA opens doors to a variety of career paths across multiple industries. There are over 670,000 active CPAs in the U.S. working in high-profile roles. With this credential, you can work in:

- Public Accounting – Provide auditing, tax, and consulting services for clients across different sectors.

- Corporate Accounting & Finance – Manage internal financial reporting, budgeting, and compliance within companies.

- Government & Nonprofit Accounting – Oversee financial management and compliance for public agencies or nonprofit organizations.

- Forensic Accounting & Fraud Examination – Investigate financial crimes, including fraud, and help resolve legal disputes.

- Consulting & Advisory Services – Offer expert advice on financial planning, business strategies, and operational improvements for various organizations.

The versatility of the CPA qualification means that you can choose a path that aligns with your interests and strengths, offering countless opportunities for career growth and specialization.

Long-term career benefits

As mentioned, CPAs tend to earn higher salaries than non-certified accountants. This higher earning potential is a significant long-term benefit, with CPAs typically making more throughout their careers.

In addition to better pay, CPAs are more likely to be promoted. Employers value the expertise and credentials that come with the CPA license, making it easier for certified professionals to move up in their careers.

Job security is another key advantage for CPAs. Many companies prefer or require CPAs for important financial positions, such as controllers, CFOs, and auditors. This demand means that CPAs enjoy strong job stability, even during economic downturns.

Overall, earning a CPA provides long-term career benefits, including higher pay, more opportunities for advancement, and greater job security.

Is Becoming a CPA the Right Career Path for You?

Becoming a CPA can be a fantastic career choice if you’re looking for stability, growth, and an exciting future in the world of accounting and finance. If you have a knack for numbers, love problem-solving, and are detail-oriented, this path could be an ideal fit for you.

The CPA credential is highly respected, and earning it opens doors to a wide range of career opportunities in fields like public accounting, corporate finance, consulting, and even forensic accounting. Plus, the earning potential is impressive, with CPAs consistently earning more than their non-certified counterparts.

The journey to becoming a CPA does require dedication, including meeting educational requirements and passing the challenging CPA exam. But the rewards far outweigh the effort.

Not only will you gain valuable skills that will set you apart, but you’ll also enjoy excellent job security, as many companies prefer or require CPAs for key financial roles. The demand for qualified professionals in accounting is strong, so you’ll find plenty of opportunities to grow and advance in your career.

If you’re ready for a rewarding and dynamic role with the potential for long-term success, becoming a CPA is a path worth considering. The effort you put in will pay off, and the opportunities ahead are promising!

Conclusion

Becoming a CPA is a great way to set yourself up for a stable and rewarding career. To build a strong foundation, the Accounting BA program at Potomac provides essential knowledge in accounting principles, financial analysis, and business operations.

Whereas for those looking to take their skills to the next level, our Accounting MA program offers advanced expertise, preparing you for leadership roles and complex challenges in the field. With the right education and dedication, you’ll be well-equipped to thrive in the dynamic world of accounting.

Frequently Asked Questions (FAQ):

How long does it take to become a CPA?

It typically takes 4-7 years, including education and experience requirements, plus time to pass the CPA exam.

How much does it cost to become a CPA?

The total cost can range from $2,000 to $5,000, including exam fees, study materials, and educational expenses.

Can I become a CPA online?

Yes, many universities offer online programs that meet the educational requirements to become a CPA.