The CPA certificate is the first step towards the highest standard of quality and competence in accounting—a CPA license. To get a CPA certificate, accountants must undergo a 14-hour test called the CPA exam. The CPA exam requirements depend on the state you apply in, and these credentials are very sought-after because of the benefits and weight they carry.

Besides the fact that it’s a recognized and well-respected credential, it could go a long way with scoring accountants a job and higher salary. Since CPAs are more in-demand than non-CPAs, it gives them a head-start with the most sought-after accounting jobs and usually makes the promotion factor easier.

To get the CPA certification, an accountant needs to have the four variables, often referred to as the four Es — Education, Examination, Experience, and Ethics.

What Is the CPA Exam?

A CPA exam is a 14-hour computer-based test, which accountants have to undergo to become a Certified Public Accountant. This test is sectioned into four parts which take place over the course of 18 months. The CPA exam is by no means a joke, as it is one of the most difficult professional credentialing exams.

This test covers a hefty amount of knowledge and accounting skills, and that is because of the great responsibility that licensed CPAs hold. These are professionals who are trusted to act in the interest of the public, hence the extensive testing of their knowledge and methods. It is, after all, the coverage of three of the four Es—Education, Examination, and Experience.

CPA Exam Requirements

There are a few boxes that need to be checked before being able to take the CPA exam. The eligibility requirements have changed over the years due to the ever-progressing ways in which accounting is done nowadays. While a certificate or an associate’s degree in Accounting aren’t enough to make you a CPA, a few years back, a bachelor’s degree in Accounting was considered enough experience and preparation for the exam.

Now, however, apart from the 120 hours that are usually encapsulated in a bachelor’s program, aspiring accountants need an extra 30 hours of graduate-level instructions. Almost all of the 50 U.S. states now have a 150-hour minimum requirement.

There are a few ways to meet the eligibility standards for this exam, from carrying a bachelor’s and a master’s degree in Accounting to a bachelor’s degree in another discipline and a master’s degree in Accounting. States may differ on their requirements, but the importance mostly seems to fall on the level of knowledge the person has.

How does an international candidate qualify for the CPA Exam?

If you are an international student, you may wonder if and how you can qualify to take the CPA exam. While applying for the CPA exam can be complicated for everyone, there’s nothing to worry about as it does not differ that much from that of non-international students.

There are specific requirements you need to meet to be eligible to apply. The requirements are set by the 55 US Jurisdiction Boards of Accountancy. These requirements can vary significantly depending on the jurisdiction you are applying for. The first step you need to take is carefully choosing the state whose educational criteria you meet. Generally, these criteria are related to education, experience, and examination.

According to the National Association of State Boards of Accountancy (NASBA), to apply successfully, international candidates must go through the steps listed below:

- Select a US jurisdiction.

- Contact the selected jurisdiction Board of Accountancy to gather the application materials.

- Complete and submit the application together with the necessary fees that you need to pay.

- Once you receive the Notification to Schedule, schedule the exam in an international location.

The international locations you can choose to take your CPA exam include:

- India,

- Nepal,

- England,

- Scotland,

- Ireland,

- Germany,

- Japan,

- South Korea,

- Brazil,

- Bahrain,

- Egypt,

- Jordan,

- Kuwait,

- Lebanon,

- The United Arab Emirates,

- Saudi Arabia, and

- Israel.

How to Prepare for the CPA Exam?

The CPA exam requires hard work and determination, and it is not an exam you can pass if you do not study systematically. Even though preparing for the CPA exam is a challenging experience, it does not have to be as stressful and time-consuming as most people consider it. By following the right study guide, preparing for this challenging exam becomes much easier. Here is a list of healthy study habits that can help you better prepare for your CPA exam:

- Start preparing ahead of time, at least 30 days before the exam.

- Take practice exams, as many as you can.

- Use the appropriate study tools.

- Focus on understanding, not memorizing.

- Take good care of yourself and get the right amount of sleep; you would not want to be tired on the day of your exam.

Applying for the CPA Exam

To start the application process, the person must first register on the NASBA site for the CPA exam registration and then fill out the application form for the state they want to be licensed in. Apart from the application fee, which is somewhere between $100 and $250, there are college transcripts that need to be sent in addition to the application form. It is advised to send all the transcripts, including any community or junior college classes undertaken.

If and when the application is approved by the state, Authorization to Test or ATT will be sent to the applicant. This is needed for the CPA exam sign-up, and it’s usually good for about 90 days, which should be enough time to make a decision on which exam to take first.

Applying for an exam section and paying the exam fees are two first steps towards it. An applicant can choose between applying for one, two, three, or all four of the exam sections at a time. After this application process, most states will issue a Notice to Schedule or NTS.

The NTS expiry dates differ among states, but it is usually good for about 18 months. In these 18 months, the applicant is expected to schedule their exam sections within the testing windows. If the NTS expires, the exam fees are forfeited and the process has to be done again from the start.

CPA Exam Cost

The entire CPA exam cost is the sum of application fees and exam fees, which may have variations in different states. Usually, the application fee, as mentioned, is around $100-$250, and each exam section costs roughly $210. Given that there are four of these sections, plus the application fee, the whole process would round up to $1000.

Those are the regular fees, but there could be additional fees if there is rescheduling, For instance, if the rescheduling happens 30 days prior to the testing day, there is no penalty, but if it happens five days to 24 hours before the test, the fee could be from $35 to $80.

CPA Exam Sections

As mentioned before, the CPA exam contains four sections. The idea of this division is to turn this lengthy test into manageable bits. The questions may vary, but the four sections always remain the same: Financial Accounting and Reporting, Auditing and Attestation, Regulation, and Business Environment and Concepts.

The difficulty each test taker feels may vary depending on their area of expertise and education, sections may seem easier or harder based on that. However, it remains a challenging test that requires months of studying and preparation. The passing bar is set at 75% of each section.

Financial Accounting and Reporting

Financial Accounting and Reporting is considered as the hardest part of the CPA exam by most test-takers. This part of the exam deals with financial statements in their entirety. They are expected to be able to form financial statements like income statements, balance sheets, cash flows, and others. It is understood that students must also know all accounting standards, how they are set, and the roles of governmental and industry groups.

| Duration: | 4 hours |

| Skills Tested: | Preparation of financial statements, types of transactions and events, accounting and reporting for all types of organizations, overall accounting standards. |

| Format: | Seven task-based simulations (40%), 90 multiple choice questions (60%). |

Auditing and Attestation

The auditing and attestation section of the CPA exam deals with standards on the preparation of audited financial statements, compliance with laws and regulations, and the difference between national and international accounting standards. Among other things, test-takers must be familiar with and identify anything unethical or in violation of professional standards, for which they should then decide how to act.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

| Duration: | 4 hours |

| Skills Tested: | Knowledge over international and national auditing standards, review and evaluation skills, knowledge of ethics, laws, regulations, and internal control. |

| Format: | Seven task-based simulations (40%), 90 multiple choice questions (60%). |

Regulation

Regulation has to do with laws surrounding accounting, all the taxation procedures, and federal taxation for entities, individuals, and property transactions. Besides that, test takers must also be aware of all the responsibilities, legal and professional, which come with the CPA title. They must present a level of understanding of the duties, rights, and liabilities of creditors, debtors, and guarantors.

| Duration: | 3 hours |

| Skills Tested: | Ethics and professional responsibility, laws and regulations, taxation and federal taxation procedures and all accounting related to it |

| Format: | Six task-based simulations (40%), 72 multiple choice questions (60%). |

Business Environment and Concepts

Business Environment and Concept will test the level of knowledge an accountant should have on financial risk management, corporate governance, financial management process, strategic planning, operations management, and other topics. These topics are related to business structure, financial management, economic concepts, and information technology. This part of the CPA exam is often referred to as the easiest section of it.

| Duration: | 3 hours |

| Skills Tested: | Business structure, financial management, economic concepts, and information technology. |

| Format: | Three written communication elements (15%), 72 multiple choice questions (85%). |

CPA Exam Questions

The CPA exam questions are divided into three groups: multiple-choice questions, task-based simulations, and written communication tasks. These are then sectioned into five smaller portions called testlets, making the exam multistage testing. The testlets are used to make the exam easier to fill in.

The testlets are usually a mix of multiple-choice questions and task-based simulations, or in the Business Environment and Concepts case, written communication tasks, too. These questions usually require a wide array of knowledge and problem-solving skills to answer.

The difficulty of the first testlet falls in the medium range, and if the score is satisfactory, then the difficulty increases in the next one. However, if the performance isn’t that good on the first testlet, then the next one will also be of medium difficulty.

A good way to prepare for the exam and its questions is following a CPA prep course and taking advantage of computerized sample tests, which would help with familiarization with the test. Also, people who have taken the test recommend a study plan and a lot of study time.

CPA Exam Pass Rate

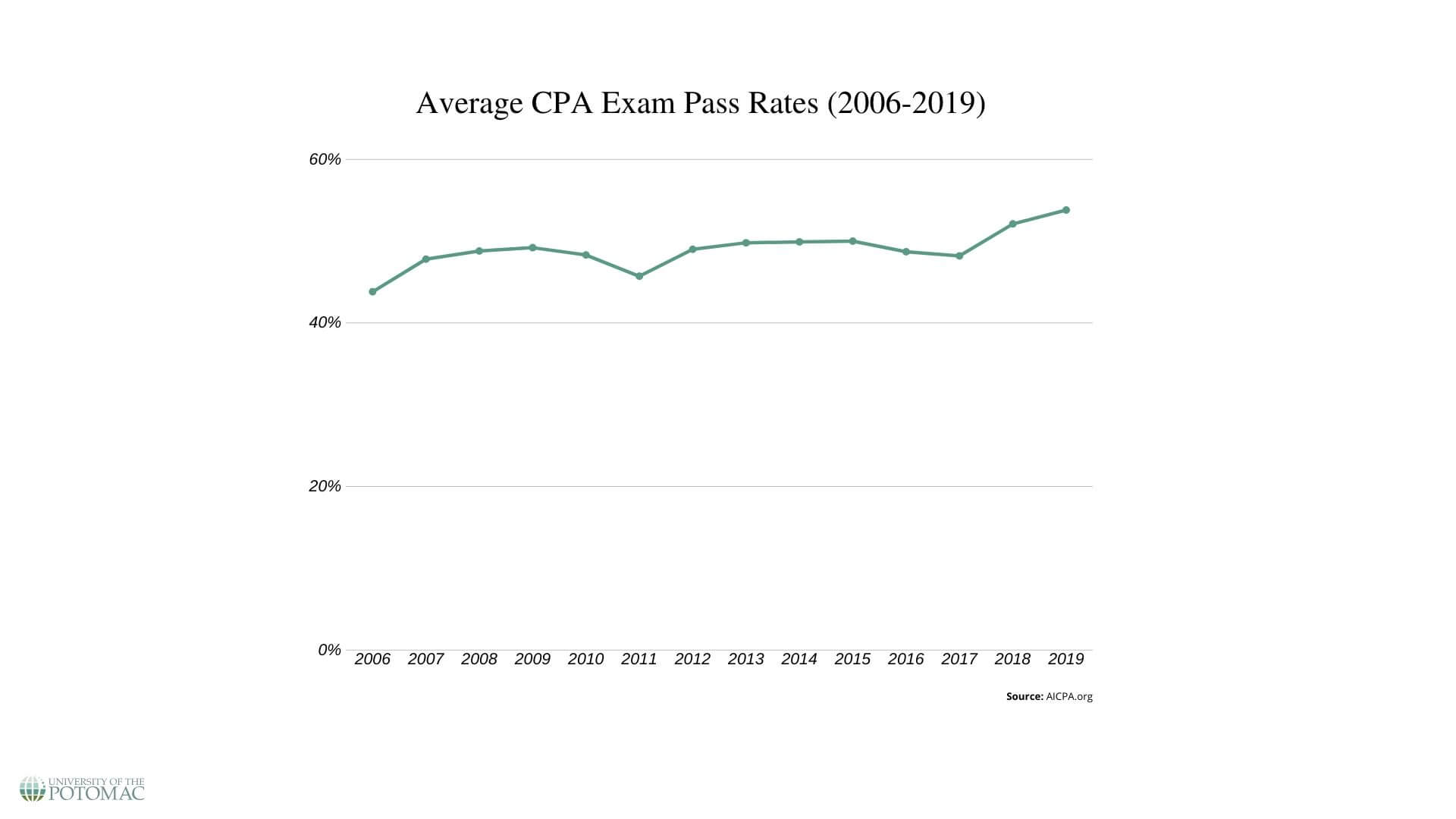

Although the CPA exam pass rate has been improving over the years, it is still not on the high end of the spectrum, circling around the 50th percentile. The difficulty this exam maintains is a result of the weight the CPA credentials carry and the standard that is set by them.

However, if we compare 2006 to 2019, we can see a significant increase in pass rates. From a 43% rate back in 2006, to a 53.8% in 2019. Although we can see small dips in 2011 and 2017, the numbers have continued to increase, and who knows what 2020 holds.

Since the sections are rated separately, the fail and success rates differ for each one. For instance, while the others have a 3%-10% difference, BEC (Business Environment and Concepts) has seen a 20% rise in pass rates from 2006 to 2019.

But, pass rates don’t only change from section to section or year to year, there’s also a considerable difference happening from quarter to quarter. According to studies, pass rates are peaking at Q2 (April to June) and Q3 (July to September).

CPA Exam Testing Windows

Testing windows are the time reserved for the CPA exam testing. Essentially, these are four periods of time during the year during which applicants can schedule their tests to be taken. During these ‘testing windows’, applicants cannot apply for the same section twice. However, during these testing windows, an applicant may take on one or more sections.

The timetables for these testing windows are updated biannually. The time between test-taking and score receiving may differ during different quarters, but usually, the score release happens ten days after the final date of the testing period.

There are four testing windows for one year:

- Q1 — from January 1st to March 10th

- Q2 — from April 1st to June 10th

- Q3 — from July 1st to September 10th

- Q4 — from October 1st to December 10th

CPA Exam Dates and Score Release Dates for 2020

The CPA exam and score release dates are available for the first two testing windows of 2020, which are Q1 and Q2.

Dates for the first testing window are:

1. Exam dates: from January 1st to January 20th

Score release date: February 4th

2. Exam dates: from January 21st to February 14th

Score release date: February 25th

3. Exam dates: from February 15th to February 28th

Score release date: March 10th

4. Exam dates: February 29th to March 10th

Score release date: March 19th

If an applicant takes the test on March 10th, but AICPA receives the exam data files from Prometric after March 11th, the score release date will change to March 20th.

Dates for the second testing window are:

1. Exam dates: from April 1st to April 20th

Score release date: May 4th

2. Exam dates: from April 21st to May 15th

Score release date: May 26th

3. Exam dates: from May 16th to May 31st

Score release date: June 8th

4. Exam dates: from June 1st to June 10th

Score release date: June 18th

If an applicant takes the test on June 10th, but AICPA receives the exam data files from Prometric after June 11th, the score release date will change to June 19th.

Getting the CPA credential is a lengthy road and requires dedication and hard work along the way, and the CPA exam is the main step towards it. From CPA exam requirements and cost to sections and questions, there are a lot of things to keep in mind and workaround. But, the key to acing it is understanding your own way of learning and the way the test works.

Good luck on your exam!