Key Takeaways

- Financial accounting records and reports on a company’s financial transactions to establish a clear view of its performance and position.

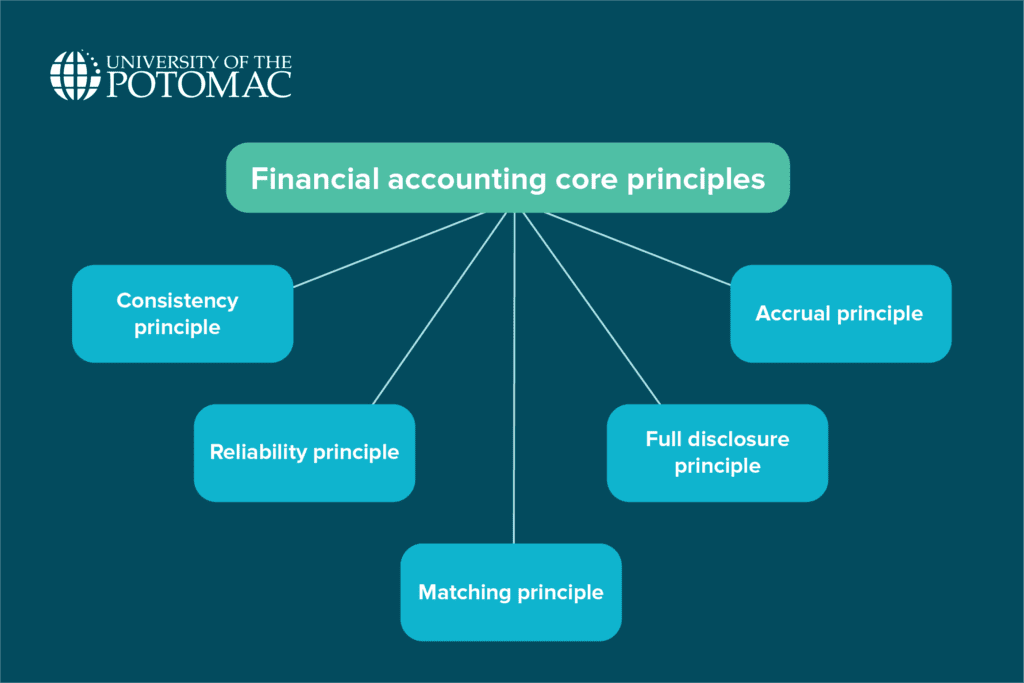

- Financial accounting is guided by core principles such as consistency, reliability, matching, full disclosure, and accrual.

- Key parts of financial accounting include double-entry accounting, the use of debits and credits, and maintaining journal entries and ledgers.

Around 5,000 years ago in ancient Uruk, a man named Kushim—believed to be an accountant or administrator—became the earliest known individual recorded by name. It’s clear that accounting has been a part of civilization for a long time and has adapted as societies have evolved.

While early accountants mainly tracked simple exchanges like goods and grain, today’s world demands specialists across countless industries and business models. Now, there are different types of accounting and, consequently, types of accountants too. Among these is financial accounting.

What Is Financial Accounting?

Financial accounting is a branch of accounting focused on recording and summarizing business transactions to prepare financial statements that reflect a company’s performance and financial position. This type of accountant gathers all the monetary activities of a business and reports them in standardized documents like the balance sheet, income statement, and cash flow statement.

The goal is to provide an accurate picture of the company’s financial health over a specific period and at a certain point in time. By following established rules and principles, financial accounting ensures that the information presented is consistent and comparable across different reporting periods and companies.

Why Is Financial Accounting Important?

Investors, lenders, and shareholders all depend on financial statements to assess a company’s profitability, stability, and growth potential. Therefore, financial accounting plays an important role in the business world because it creates a shared financial “language” for communicating business results to all these groups.

Financial accounting also promotes overall transparency and comparability across businesses, which strengthens trust in the financial markets and supports a stable economy. By following common principles, companies are held accountable for disclosing essential information.

Core Principles of Financial Accounting

To make financial reports useful and trustworthy, companies are required to follow established frameworks such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The goal of these frameworks is to ensure that all businesses report data in an ethical and consistent way.

Some of the key principles they must follow include:

- Consistency principle: Once a company chooses an accounting method or policy, it should apply it consistently from period to period.

- Reliability (objectivity) principle: Financial information should be reliable, based on objective evidence and verifiable data, and free from bias.

- Matching principle: This principle states that companies should record expenses in the same period as the revenues those expenses helped to generate.

- Full disclosure principle: All information that is relevant to users’ understanding of the financial statements should be fully disclosed in the reports or notes.

- Accrual principle: Companies should record revenues and expenses when they are earned or incurred, not when cash is received or paid, to give a more accurate picture of financial performance.

Key Parts of Financial Accounting

Financial accounting revolves around recording transactions, and to do that accurately, accountants use a structured system. These systems encompass various elements, with some of the most important ones being:

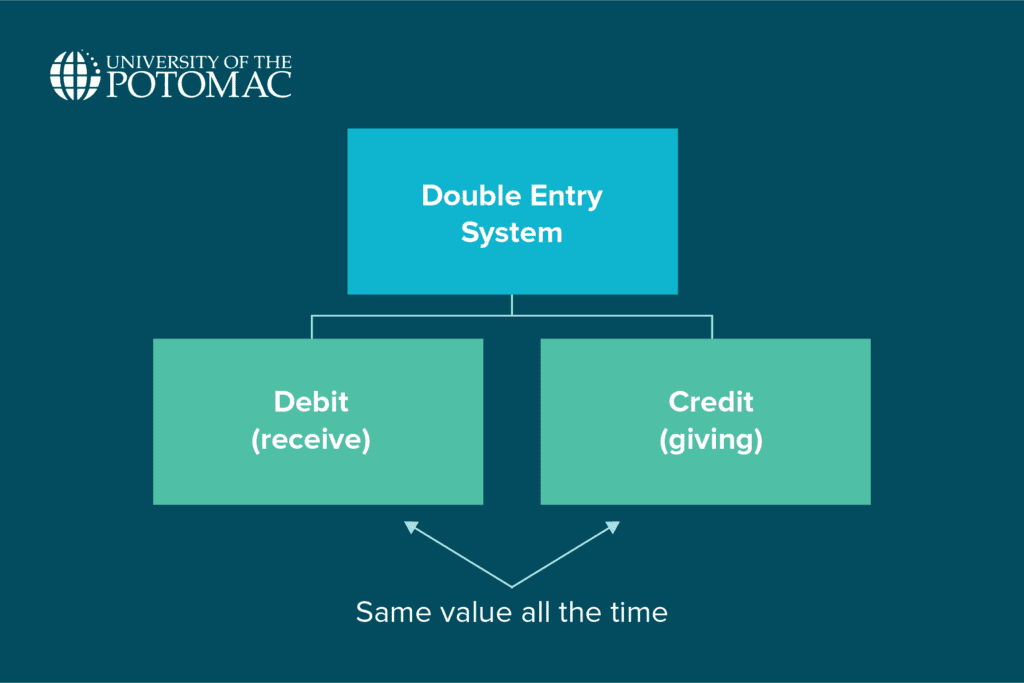

Double-entry accounting

In double-entry accounting, every transaction affects at least two accounts: one that is debited and another that is credited for the same amount. This method is based on the idea that every financial event has a dual impact.

For example, if a company spends $500 in cash to buy office supplies, it will credit (decrease) its Cash account by $500 and debit (increase) its Supplies (asset) account by $500. The equal debit and credit keep the fundamental accounting equation in balance: Assets = Liabilities + Equity.

Double-entry accounting acts as a built-in error-checking system. The total debits should always equal the total credits. If they don’t, it signals a mistake in the recording.

Debits and credits

In accounting, “debit” and “credit” are, essentially, the language of entries. A debit (Dr) is an entry on the left side of an account, and a credit (Cr) is an entry on the right side. Each type of account has a normal balance, which is either debit or credit.

Asset and expense accounts typically increase with debits, while liability, equity, and revenue accounts increase with credits. Using the earlier example, buying $500 of supplies (an asset) increased an asset account, so we debited Supplies. The cash account was decreased (cash is an asset going down), so we credited Cash.

Every transaction will have at least one debit and one credit, and the total debits must equal the total credits for each entry.

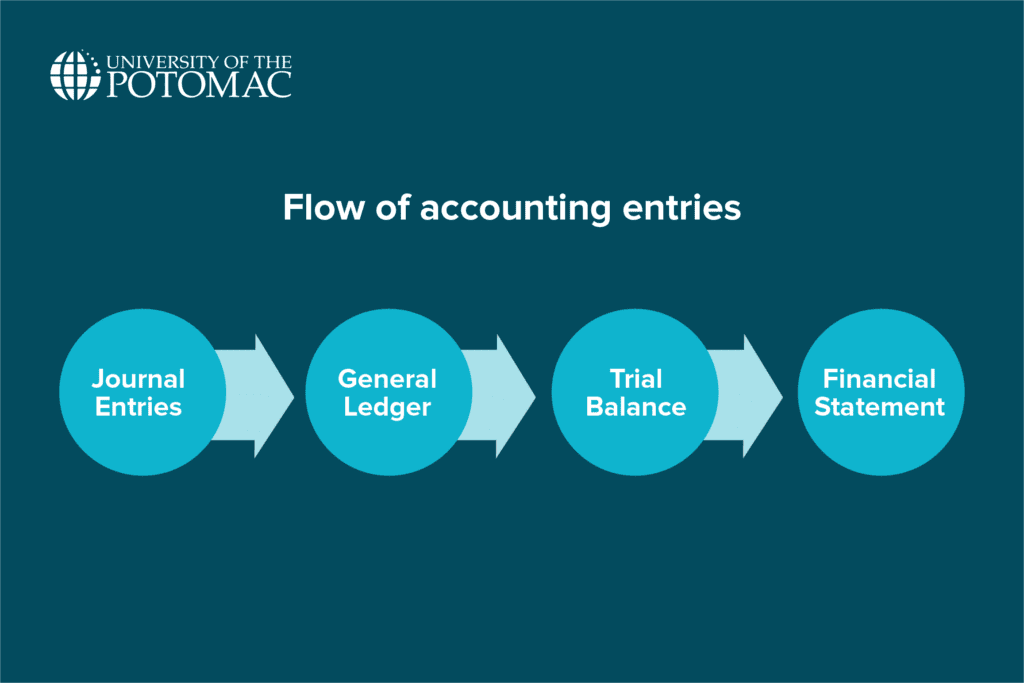

Journal entries and ledgers

A journal is the chronological record of all a business’s financial transactions. When a transaction occurs, it is first recorded as a journal entry in the general journal with the date, accounts involved, debits, and credits noted.

Modern accounting software records journal entries behind the scenes whenever you input a transaction, but the concept is the same.

After journal entries are made, the amounts are posted to the corresponding ledger accounts. By the end of the period, the ledger accounts’ balances are used to prepare a trial balance and the financial statements.

Understanding the Financial Statements

The ultimate output of financial accounting is a set of financial statements that helps summarize a company’s financial performance and position. There are three primary financial statements that businesses should prepare:

Balance sheet

The balance sheet shows what a company owns and owes at a specific point in time. It’s like a snapshot of the business’s financial condition on a particular date.

Stakeholders examine the balance sheet to assess things like liquidity and capital structure. Because it rolls over from period to period, the balance sheet also links to the next period’s opening balances. So, the balance sheet addresses the key question many stakeholders have: “Where does the company stand financially at this moment?”

Income statement

The income statement provides a summary of the business’s performance over a given time frame, usually a month, quarter, or year. It lists the revenues earned and expenses incurred during that period, and the difference between them is the net profit or loss.

The format is straightforward: revenues are at the top, then various categories of expenses (cost of goods sold, operating expenses, interest, taxes, etc.), and finally, the resulting net income (or net loss) is at the bottom.

This type of statement covers all the activity between two balance sheet dates.

Cash flow statement

The cash flow statement reports the actual cash inflows and outflows of the business over a period of time. It’s often divided into three sections: operating activities, investing activities, and financing activities.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

Operating cash flow starts with net income (from the income statement) and adjusts for non-cash items and changes in working capital to show cash generated by the core business operations. Investing cash flow reflects cash spent on investments like purchasing equipment or acquiring other businesses (as cash outflows) and cash received from selling assets or investments (inflows).

This statement reveals whether the company is actually generating cash. A company might show a profit on the income statement but still run out of cash if, for example, its money is tied up in inventory or customers haven’t paid yet. The cash flow statement cuts through accounting nuances to show “cash in vs. cash out.” Stakeholders use it to evaluate the company’s ability to meet obligations and fund growth.

How to Become a Financial Accountant

Financial accounting is a professional career that typically requires appropriate education, credentials, and skills. The steps you should take toward a career in financial accounting include:

Earn a relevant degree.

In most cases, the first step to becoming an accountant is to earn an accounting degree. For entry-level accounting positions, a bachelor’s degree in accounting or a degree in finance or business is usually necessary.

Some employers (especially larger companies or public accounting firms) prefer candidates with a master’s degree in accounting or an MBA with an accounting focus.

2. Earn certifications

The most widely recognized certification in financial accounting is the CPA (Certified Public Accountant) license. To advance in many accounting careers or to work in public accounting or high-level roles, becoming a CPA is often a prerequisite.

Besides the CPA, there are other certifications depending on your career direction, such as:

- CMA (Certified Management Accountant)

- CIA (Certified Internal Auditor)

- CFE (Certified Fraud Examiner)

- CFA (Certified Financial Analyst)

3. Develop your skills

Being a successful financial accountant isn’t just about degrees and exams. You need certain skills and qualities to be able to fulfill your duties in this role. Some must-have traits include:

- Attention to detail

- Analytical skills

- Critical-thinking skills

- Math skills

- Communication skills

- Organizational skills

- Tech skills

4. Gain experience and start your career

With a degree (and perhaps a certification in progress), you can begin in an entry-level role. Common starting positions include staff accountant, junior accountant, or audit associate (if you join an accounting firm).

The experience gained will prove invaluable to progressing in your financial accounting career.

Financial Accounting Career Opportunities

Some of the career opportunities and roles that are commonly associated with financial accounting include:

- Financial Accountant

- Management Accountant

- Auditor

- Financial Analyst

- Controller

- Chief Financial Officer (CFO)

- Tax Accountant

- Forensic Accountant

- Internal Auditor

- Accounting Consultant

- Budget Analyst

- Compliance Officer

Conclusion

Professionals working in financial accounting are the ones responsible for building the official record of a company’s financial health. Without their reports, businesses couldn’t make informed decisions, investors couldn’t gauge opportunities, and regulators couldn’t ensure accountability.

At the University of the Potomac, you can take the first step toward mastering this essential field. Our Bachelor of Science in Accounting program equips you with the core knowledge, technical skills, and ethical grounding needed to succeed as a financial accountant. For those ready to advance even further, our Master of Science in Accounting offers deeper specialization and prepares you for leadership roles, certifications like the CPA, and long-term professional growth.

When it comes to your future, think of Potomac as the place where your balance sheet starts strong and where your investment in yourself can grow into lifelong equity.

Frequently Asked Questions

Is financial accounting a lot of math?

Not necessarily. While working with numbers is a part of financial accounting, it does not require sophisticated mathematics; instead, it primarily uses very basic algebra and arithmetic.

What type of accountant gets paid the most?

Generally, accountants who hold advanced certifications and advance into senior leadership or specialized roles earn the highest salaries.

What is the difference between financial and managerial accounting?

While managerial accounting deals with internal reports that assist managers in making business decisions, financial accounting is primarily concerned with producing standardized reports for external stakeholders.