To become an accountant, you need to put in a lot of dedication, accompanied by hard work. There’s more to this list, as you also need to invest time and money to take the adequate courses, earn certification, and finally get a job. It may sound like a tough reality when you think about the long road you have to take, so you’re probably wondering if an accounting degree is worth the effort after all?

There’s no one-size-fits-all answer to that question. However, through this guide, we will try to provide you with as much relevant information as possible for you to make the decision for yourself.

Types of Accounting Degree Programs

If you already started your research for a career in accounting, you will understand that you have many different education levels ahead of you. Depending on your choice, you also determine the kind of job you want to have and the life you want to lead. So it’s definitely something to think carefully about. To help you with the process, we’ve gathered some of the most important features that correspond to each accounting degree. Below you will read on:

- The certificate or Diploma in Accounting

- The Associate’s Degree in Accounting

- The Bachelor’s Degree in Accounting

- The Master’s Degree in Accounting

Certificate/Diploma in Accounting

Except for choosing to pursue a complete degree in accounting, you can also choose to benefit from certification programs that can help you advance your professional skills. These programs develop student’s vocational skills and carve their way into entry-level positions. General certificate programs will enhance your marketable skills for jobs related to office reception and administration, computer applications support, accounts receivable and payable and computer security. Or you can choose advanced certificate options in Business Accounting, which we just happen to offer here at the University of Potomac.

| Duration | Requirements | Jobs |

|---|---|---|

1/2 years | Varies by state and residency. Generally: Application fee, High school diploma, GED, the number of credits completed, Transcripts, Specific prerequisite coursework, Professional ethics exam. | Associate Degree in Accounting Accounting Assistant Auditing Clerk Financial Reporting Clerk Accounting Technician Accounts Payable Accounts Receivable Administrator |

Associate’s Degree in Accounting

The role of an Associate of Science degree in Accounting is for students to get all prepped up for entry-level positions. They learn some basic accounting skills such as analyzing transactions, preparing journal entries and posting to ledgers. Thereof, their future professions may include bookkeeping, accounts receiving clerks and accounts payable clerks.

| Duration | Requirements | Jobs |

|---|---|---|

| 2 years | 60-65 hours of completed coursework, High school diploma, GDE, Minimum GPA, General education courses – including Math; | Bookkeeper Staff Accountant Accounting Manager Financial Controller |

Bachelor’s Degree in Accounting

If you want to become an actual certified public accountant (CPA), you will have to fulfill the minimum standard of holding a bachelor’s degree in accounting, also called a degree in accountancy. A full 4-year bachelor program generally takes at least 120 credit hours, though if you already earned an associate’s degree, you’ve got the first 60 covered. This means you’ll be through with the general education courses, and you can move on to the main classes focusing on accounting, business, finance, math, and statistics.

| Duration | Requirements | Jobs |

|---|---|---|

4 years | Degree requirements vary by school and program: Approximately 120 credit hours, including a general education curriculum (i.e. communications, math and science, social science, arts and humanities, health and wellness), as well as specialized courses related to the accounting major. | Public Accountant Auditor Corporate Accountant Tax Examiner – Collector Revenue Agent Internal Auditor Chartered accountant Chartered certified accountant Chartered public finance accountant Company secretary Forensic accountant Stockbroker |

Master’s Degree in Accounting

A Master’s degree in accounting provides advanced coursework for those looking to further specialize their careers within the accounting field and/or obtain a CPA license. This degree prepares individuals to better face the diverse labor market, and become more competitive in the increasingly cross-disciplinary focus of accounting.

| Duration | Requirements | Jobs |

|---|---|---|

| 1-2 years | Undergraduate degree, Completed courses in Statistics, Principles of Accounting, Finance and Pre-Calculus, Satisfactory GPA, GMAT. | Financial Analyst Information and Technology Accountant Forensic Accountant Managerial Accountant Corporate Controller Chief Financial Officer |

MBA in Accounting

An MBA in Accounting is a professional graduate degree program that offers students the opportunity to earn high-level business curriculum so that they can become knowledgeable and well-rounded business professionals. Different from master’s degree programs, MBA programs have a higher concentration in advanced business courses to learn a variety of different skills and concentration courses that pertain specifically to principles that apply to the field.

| Duration | Requirements | Jobs |

|---|---|---|

| 1-2 years | No previous major in Accounting is required, Any accredited four-year degree, professional experience (from 2 to 3 years) | Management Analyst Financial Managers Personal Financial Advisors Chief Financial Officer Business Development Manager |

PhD or DBA in Accounting

You’ll find it rather hard to choose between accounting doctorates, as there are a few of them, consisting of 4 key choices:

- Doctor of Philosophy in Business Management – Accounting Specialization

- Doctor of Accounting and Financial Management

- Doctor of Business Administration-Accounting/Financial Management Specialization

- Doctor of Professional Studies in Business – Finance Concentration

The most significant difference between the doctor of philosophy (PhD) and the Doctor of Business Administration (DBA) is in the orientation and intended outcome. While PhD programs are more oriented toward teaching and developing new theory, DBA programs are more oriented toward applied theory. Either program may have more or less of a research or teaching focus. Hence, your choice will be based on whether or not you plan to stay in the world of academia after graduation.

| Duration | Requirements | Jobs |

|---|---|---|

| 1-5 years | Depending on university guidelines. Generally: A Bachelor’s degree and a Master’s degree or experience in the field, GMAT or GRE scores, Proof of an academic background in subjects such as Mathematics, Statistics, and Economics. | College or university professors Consultants Financial analysts Public policy researchers Researcher |

Online Accounting Degree

As the economy continues to grow, the need for financial advisors and accountants rises up as well. Lucky for you, responding to this demand has never been easier, due to the online opportunities to advance your career. Online accounting programs prepare graduates for pretty much the same careers as a traditional process of certification would, for instance, in public accounting, auditing, managerial accounting, and budget analysis.

Many online accounting degree programs also offer concentrations, such as auditing, forensic accounting, and public accounting. Needless to say that with an accredited university, an online degree can give you a bright future.

| Duration | Requirements | Jobs |

|---|---|---|

| Depends on the degree type | Minimum GPA, Application fee, Transcript of records, Letters of recommendation, SAT / ACT test scores. | Auditor Audit Management Accountant Budget Analyst Fraud Examiner Forensic Auditor Financial Analyst |

Accounting Program Courses

The CPA Exam

The Uniform Certified Public Accountant (CPA) examination is a required element and a crucial step in an aspiring CPAs journey to professional practice. Professionals from the world of finance and accounting are trusted with great responsibilities; hence, the accounting industry has set professional standards that allow licensure to qualified individuals only. The four variables that qualify a licensed public accountant are commonly known as the Four E’s: education, experience, examination, and ethics.

What are the CPA exam requirements?

In order to meet the CPA exam requirements, you may want to check with the rules set by the state in which you’re planning to take the exam. That because individual states may differ in their requirements. For instance, some states demand residency or proof of citizenship, while others do not. Or they may require a specific Master’s degree in accounting from you or another degree that is relevant. However, generally speaking, CPAs meet educational eligibility via:

- A bachelor’s degree in accounting, plus a master’s degree in accounting;

- A bachelor’s degree in another discipline, plus a master’s degree in accounting or taxation, or an MBA with a concentration in accounting;

- A dual program that delivers both bachelor’s and master’s degrees in accounting in five years of study;

- A bachelor’s degree in accounting, supplemented by 30 semester hours of graduate-level instruction in taxation and accounting;

How much does the CPA exam cost?

NASBA has established a fee schedule for each exam section. Still, boards of accountancy manage these fees in individual states or jurisdictions, and they are exposed to change depending on these states. That’s why you should also check carefully for these variations that relate to the following:

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

- Cost of the CPA Review Course

- CPA Exam Application Fee

- Examination Fees

- Registration Fees

- CPA Ethics Exam Fees

Accounting Jobs

Majoring in accounting provides you with a bountiful list of career opportunities and helps you keep your options open as you advance professionally. The jobs often vary on the type of degree and certification level that you have, and they may start from entry-level positions to top management ones. Let’s take a look at some of the most well-paid jobs in Accounting.

1. Accounting Professor

Depending on your accounting degree, choosing a career path in academia is highly rewarding. Especially if you like to inform upcoming generations on the adequate techniques of managing numbers and finance. You will need, at a minimum, a master’s degree to pursue this profession; however, a PhD is more recommended to keep you updated with the latest demands of the labor market.

2. Director of Finance & Administration

Practice makes perfect; that’s why this position is mostly presented to people who have some years of experience in the business industry and that hold an MBA concentration in finance or accounting. It requires lots of important responsibilities related to the financial and administrative aspects of a company. You will also need to have a good sense of communication along with leadership skills, as you will be managing several people from different department heads.

3. Corporate Controller

Corporate controllers have responsibility for all accounting-related activities, including high-level accounting, managerial accounting, and finance activities, within a company. Their duties include assisting with the preparation of the operating budgets, overseeing financial reporting, and performing essential responsibilities relating to payroll. All financial functions route through these individuals, that’s why they are considered a firm’s top accountants.

4. Internal Auditing Manager

We are all aware of just how vital the process of auditing is for businesses. Internal auditing managers are qualified individuals in charge of harmonizing all company operations with relevant governmental regulations, internal standards, and insurance stipulations. In order to be a top performer at this job, you will need to possess loads of analytical skills, communication skills, business acumen, and general IT knowledge.

5. Investment Banker

The good news is that you only need a minimum of a bachelor’s degree to work as an investment banker. There are many other entry-level positions in this field open to bachelor’s degree, and you can even move to the role of a senior banker without further qualification needed. Investment bankers are important intermediaries providing financial advice for clients who want to grow their businesses and raise their capital.

6. Financial Planning & Analyst Manager

Being in charge of making decisions that will impact the financial aspect of an entire company is a big deal. That’s why the salary is very much proportionate to this level of responsibility. A career in financial planning is very prospective, as professionals of this field help foresee and reduce any financial risks that may arise for firms or different clients.

7. Finance Director

Finance directors can usually be c-level executives holding MBA degrees with concentrations in finance or accounting. They might also have a law degree as well, with the condition of having many years of proven success in the field. Specific experience in investment banking might be helpful in landing such a position, particularly with companies in your industry of specialization.

8. Director of Risk Management

A director of risk management oversees risk management within a company. They take a lead role in developing risk management strategies in harmony with fundamental laws and business principles of the company itself. A bachelor’s degree may be enough to get you started in this field; however, to keep your professional worth higher and safer, a Master’s degree is certainly needed. Your potential employers for this position will include high tech firms and government agencies.

9. Chief Financial Officer

The Chief Financial Officer is an important factor of a company whose role goes quite inseparable from the CEO of the company. This person is likewise accountable to the board of directors if there is one. What is usually expected from a CFO is precise, excellent expertise in creating budgets, knowledge of debt and credit instruments, as well as an in-depth understanding of economics.

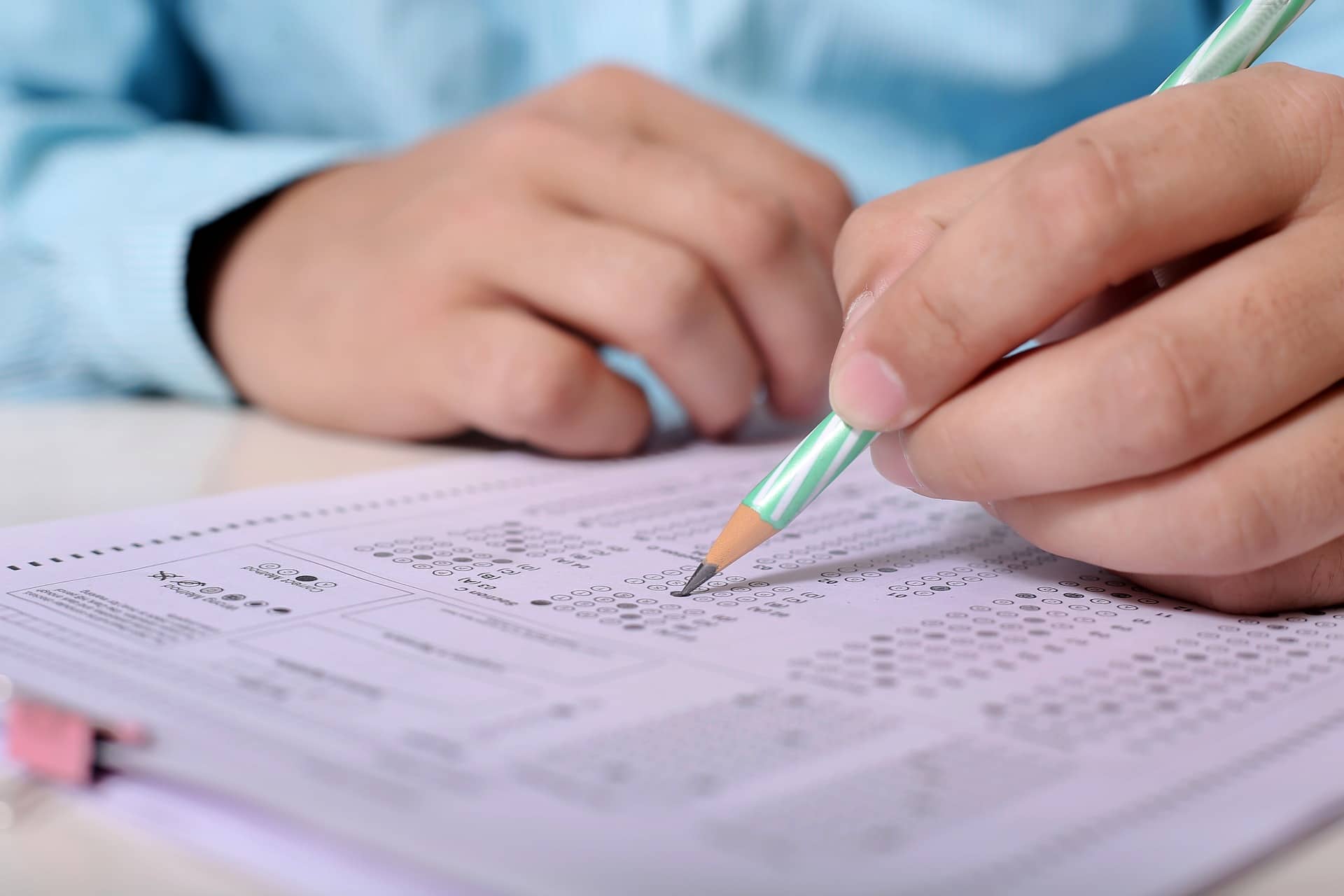

Average Accounting Salary

We mentioned several times that the career of accounting is highly rewarding from the financial aspect. Entry-level accountants may earn a reasonable income, but like most professionals, their earning potential rises with time, experience and qualification. There are many employers that will offer you enormous figures with minimal education or others that will appreciate your level of experience.

According to resources from the U.S. News, accountants made a median salary of $69,350 in 2017. The best-paid 25 percent earned $91,770 that year, while the lowest-paid 25 percent made $54,250. If that’s not enough of a motivation, let us inform you that chief financial officers make $130.000 per year. How’s that for an incentive?

What about the salary of a freelance accountant?

An accountant’s fee of services depends on the kind of services he or she will provide for you. Online working platforms have made it possible for accountants to be exercising their profession in multiple positions at a time. These freelance accountants with a bachelor’s degree usually charge $150-$400 or more an hour, depending on the type of work, the size of the company and its location. You’ll pay lower rates for routine work done by a less-experienced associate or lesser-trained employee, such as $30-$50 for bookkeeping services.

Distinct Benefits of Studying Accounting

When searching for career choices, we all try to foresee the best opportunities that a career holds for our future. So what can be the benefits that would make one choose a career in accounting? Read below as we have listed some of them.

1. Job Security

The world of business will always, and we highlight it –always- need professionals in the field of finance, that are good with numbers, can conduct risk analysis assessments and that can keep a company profiting from the labor market. Since the demand is ongoing, investing in an accounting career will let you lead a carefree life, sure of the choice you made.

2. Flexibility

Technology can offer accountants many flexible solutions for their working hours. You can finally achieve that so-called work-life balance, and manage to spend more quality time with your loved ones. And not just that, you can work simultaneously for different companies that require your freelance accounting services.

3. Financial Prospects

Potential earnings are limitless in accountancy and finance, specifically if your degrees belong to a higher level of education or if you happen to run your own business. Experienced accountants working at the highest levels in the private sector or public one often demand extraordinary prices for their services. And considering the work they do, of course they’re worth it.

4. Career independence

People in accounting mostly do their work individually, gathering data from different people within the company but doing the analysis part themselves. This provides them with significant independence and time-management skills. If not that scenario, then with some experience in accounting you can open your own business, run it and hire your own staff. After some years in this industry, you will understand the ins and outs of the market, hence, your entrepreneur skills will come in handy.

Is an Accounting Degree Worth It?

When you come down to the final decision of whether it’s worth pursuing a degree in accounting or not, you will have to consider your career goals, the costs of education, the time and energy it takes you. But there’s one thing we can tell you for sure: the demand is your safety key.

Regardless if you’re an accountant, auditor, bookkeeper, budget analyst, or tax specialist, rest assured that the need for the work you do will always be current. Accounting and Finance are considered as some of the most valuable and in-demand college degrees today because businesses need this set of skills to keep their financial documents in check!

The U.S. economy is constantly growing, employment of accountants and auditors is projected to grow 10 percent from 2016 to 2026, faster than the average for all occupations. All hints from the future are bright when referring to a career in accounting, so we think investing in a degree within this field is certainly worth it.