Key Takeaways

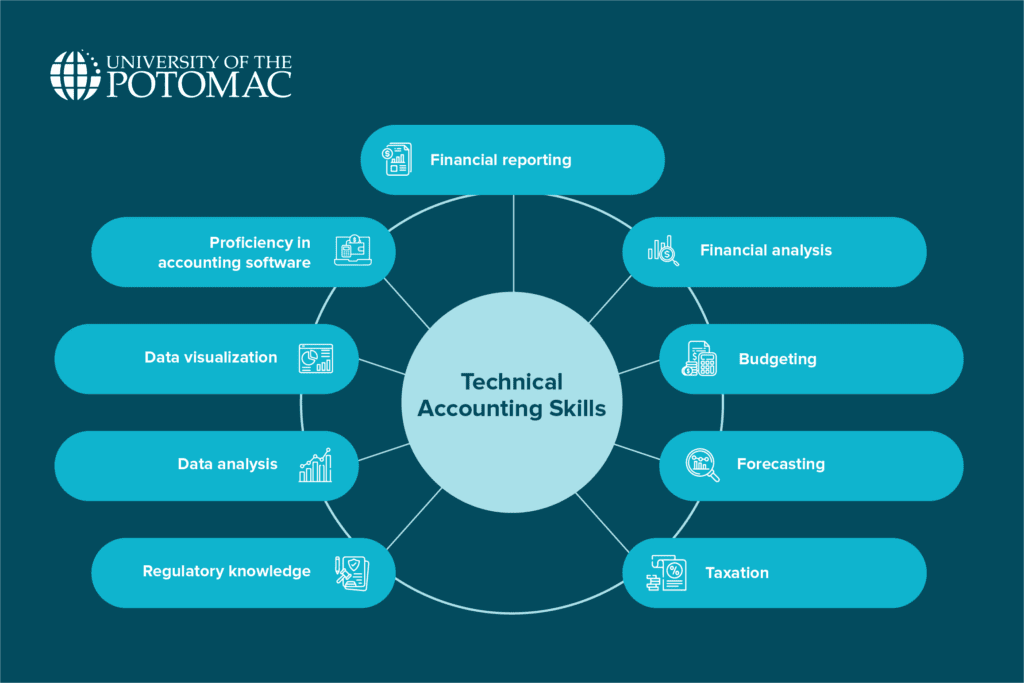

- Technical accounting skills in financial reporting, budgeting, taxation, and data analysis are crucial for accountants.

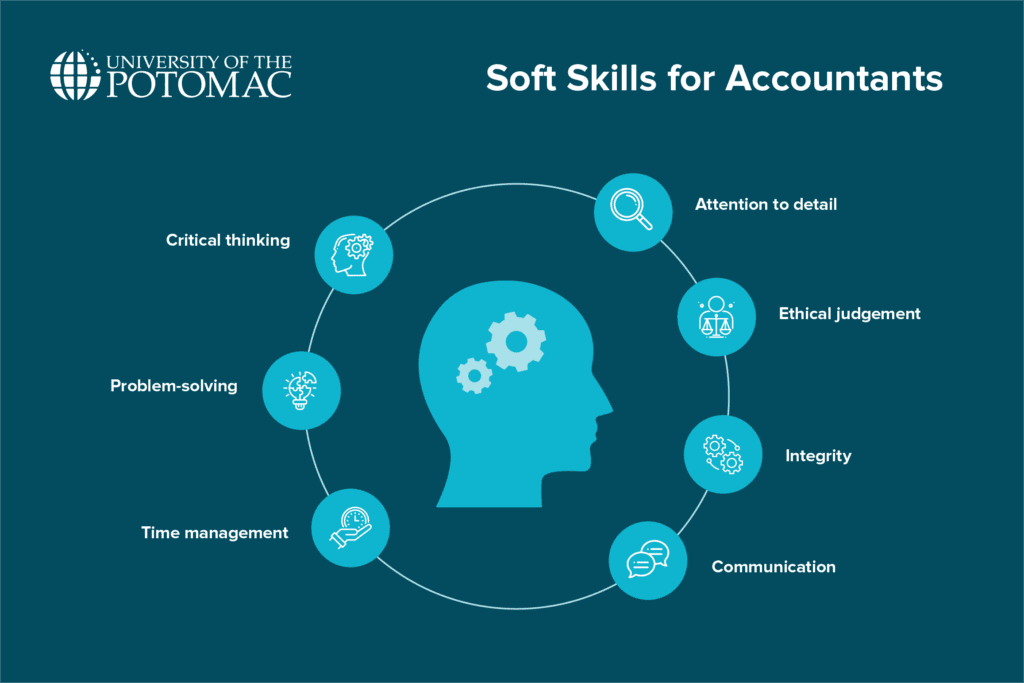

- Some of the soft skills necessary for accountants include attention to detail, ethical judgment, communication, and problem-solving.

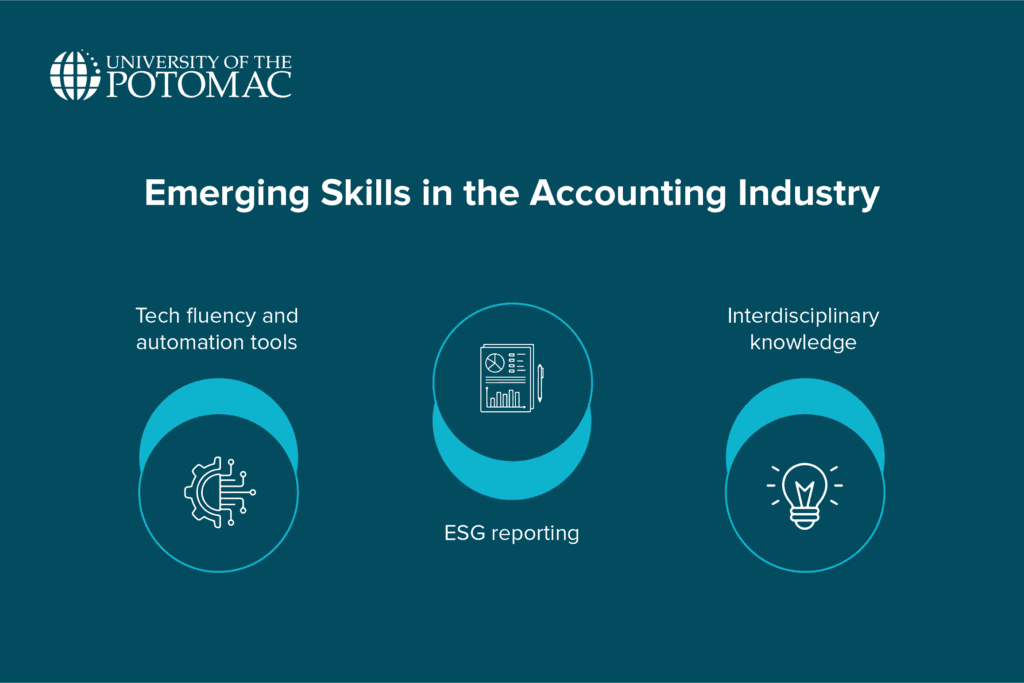

- Current emerging skills in accounting include tech fluency, ESG reporting, and interdisciplinary knowledge.

Accounting is a field that focuses on tracking and reporting financial information to help individuals and businesses understand their finances. It involves monitoring cash flow, expenses, income, debts, and other financial activities.

In small companies, one accountant might handle these activities, while bigger companies may have a whole team. However, in every situation, individuals working in this field need to possess strong accounting skills to ensure that this information is accurate and significant.

Core Technical Accounting Skills

Technical skills are the abilities and knowledge required to carry out specific job tasks. These skills are often taught through formal education and training programs.

Some of the most important skills of an accountant include:

Financial reporting and analysis

Although it may seem obvious, accountants need to be technically proficient to analyze a company’s financial data and generate reports about it.

Financial reporting skills relate to the knowledge and abilities that go into preparing reports like balance sheets or income and cash flow statements, which show what a company owns, earns, spends, and owes. Once the reports are prepared, the analysis phase comes in, and accountants review the numbers to spot trends, compare results over time, and assess financial health.

Budgeting and forecasting

Every successful company needs a plan, which is why technical skills in forecasting and budgeting are essential. Budgeting involves creating a spending plan based on expected income and expenses, while forecasting uses past data to predict future earnings, costs, and financial trends.

These skills help businesses make informed decisions about where to invest, when to cut back, and how to grow responsibly. Accountants who excel in budgeting and forecasting are crucial for keeping operations on track and planning for the future.

Taxation and regulatory knowledge

Accountants are also responsible for keeping businesses legally and financially safe. This means that they need to have up-to-date knowledge of tax laws, financial regulations, and accounting standards to ensure all taxes are paid and filed properly, file the right paperwork on time, and follow the rules set by local, state, federal, or even international authorities.

An accountant with this set of skills is what helps businesses avoid penalties and reduce legal risks.

Data analysis and visualization

Since the work of modern accountants often necessitates deriving meaningful insights from financial data, they need data analysis and visualization skills that enable them to work with large data sets and present their findings.

These skills help accountants identify trends in the data, detect unusual activity, and use the insights gained to support decision-making. It’s through data analysis skills that accountants ensure accuracy, while visualization tools, like graphs, dashboards, or heat maps, make complex data easier for others to understand and act on.

Proficiency in accounting software

Thanks to technological developments, particularly accounting software applications, accountants no longer need to do accounting by hand. They can work with bookkeeping or enterprise accounting programs, like QuickBooks, Xero, SAP, and Oracle NetSuite, as well as other related tools for spreadsheets and business intelligence.

Being skilled in working with software allows accountants to automate repetitive tasks, reduce errors, and work more efficiently. By becoming tech-savvy, they can simplify various financial processes and stay competitive in a tech-driven industry.

Must-Have Soft Skills for Accountants

Successful accountants also rely on a range of soft skills that are relevant to an accountant’s duties. Some of the most important ones include:

Attention to detail

Accuracy matters, particularly in accounting, where a small error can lead to significant consequences, especially when it comes to financial reports or tax returns. Good accountants must therefore typically be meticulous to ensure that every transaction is accurately documented.

This skill is put to use whenever accountants are scrutinizing documents, like invoices, ledgers, and financial statements, as well as looking for inconsistencies or mistakes that others might overlook. With accountants being meticulous and thorough, they maintain the reliability of financial information.

Ethical judgment and integrity

Accountants are entrusted with sensitive financial information and must adhere to high ethical standards and show integrity. This means that they must be honest and transparent in all their accounting practices so the financial reporting is truthful and compliant with laws.

Being able to make moral decisions under pressure and successfully navigate complex situations by prioritizing the interests of clients and the public are key components of having strong ethical judgment.

Accountants often reference professional codes of conduct, like the AICPA’s Code of Professional Conduct, for instance, to guide their decisions.

Communication skills

Though accounting primarily revolves around numbers, words, namely communication, are also crucial. This includes both written and verbal communication.

Communication skills are needed whenever accountants share insights with other financial and accounting team members, as well as when they explain financial concepts in simple terms to clients, colleagues, or executives who may not have a finance background.

Time management

Since the accounting industry involves a wide variety of duties, accountants frequently have to balance several obligations and tight deadlines. Their ability to prioritize work, plan their workflow, and meet deadlines is a result of their accounting skills.

By managing their time well, accountants can handle peak workloads, like preparing numerous reports by month-end, and do so without sacrificing quality for quantity.

Problem-solving and critical thinking

Accountants often face challenging financial circumstances that require more than just following procedures. So, they need to be skilled when it comes to problem-solving and critical thinking, too.

Such skills enable these professionals to assess a situation and consider the best course of action to find solutions. The important thing is that these actions are informed, objective decisions. Instead of simply accepting figures at face value, as a critical thinker, an accountant should question results, check for inconsistencies, and always look at the bigger picture.

Emerging Skills in the Accounting Industry

The accounting industry evolves and changes with time, and new skill sets are coming to the forefront. In recent years, several emerging skills have become highly valuable for accountants who aim to stay relevant:

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

Tech fluency and automation tools

All modern accountants need to be comfortable working with advanced technologies like cloud-based accounting systems, automation, and AI tools. So many of the tasks that used to be done manually, like data entry or bank reconciliations, can now be handled by Robotic Process Automation (RPA) or intelligent software.

Accountants with tech fluency can use these tools in order to increase their efficiency and reduce possible errors. For example, knowing how to use an AI-powered system can help an accountant flag unusual transactions much more easily and quickly.

Embracing automation and software also comes with the benefit of freeing accountants’ time to focus on more strategic analysis.

Environmental, social, and governance (ESG) reporting

ESG reporting has become a trend as accountants evaluate and disclose a firm’s impact on the environment, its stakeholders, and how it’s governed. This means that accountants need to also be skilled in tracking metrics like carbon emissions, workforce diversity, community investments, and more, as well as be able to integrate the numbers with financial reports.

As ESG factors become tied to investment and compliance, having skills in this area can set an accountant apart and show their commitment to keeping up with trends. It broadens the accountant’s role to include that of a business advisor.

Interdisciplinary knowledge

The most sought-after accountants are typically those with transferable skills and the ability to link accounting to other fields. For example, accountants with a good understanding of IT or programming can work with system implementations or data analytics and branch out their expertise in other areas of a business as well.

Interdisciplinary knowledge allows accountants to be more thorough and contribute insights that pure accounting training alone might not cover.

How to Develop and Improve Accounting Skills

Accounting skills aren’t something you can learn once and then simply rely on them for the rest of your career. As new regulations are set, technologies are developed, and new practices emerge, then it means that even experienced professionals must continue learning and adapting.

Building strong accounting skills is a continuous process, and starting with a solid educational foundation is the best way to set yourself up for long-term success. Programs like the University of the Potomac’s Accounting BA program and Accounting MA program provide learning and training that covers various areas, from financial reporting and taxation to auditing and ethics.

Pursuing professional certifications can also further strengthen your expertise and credibility. Credentials like the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) are some renowned options worth looking into. Accountants can also sharpen their skills through short online courses and workshops, as some options offer focused learning on various topics relevant to the field.

Informal learning plays a role as well. On-the-job training, mentorship from more experienced colleagues, and self-study through books, simulations, and real-world case studies will help you stay sharp and apply what you’ve learned to everyday work situations.

Conclusion

Training for a career means building the technical and soft skills that allow you to handle both the expected tasks and the unexpected challenges that come your way. A strong accounting professional is someone who can prepare reports or manage budgets as well as they can think critically, solve problems, communicate clearly, and adapt when situations don’t fit neatly into predefined roles.

Accounting remains one of the most reliable and rewarding career paths you can pursue. That is why earning a degree in accounting is a smart investment in your future—and choosing to study with us at the University of the Potomac ensures you will gain the skills, knowledge, and practical understanding needed to build the foundation for lasting achievement.

Frequently Asked Questions

What’s the difference between accounting skills and bookkeeping skills?

While accounting skills are more general and include evaluating, interpreting, and reporting financial data to aid in decision-making, bookkeeping skills are typically focused on the process of accurately recording financial transactions.

Which industries require the most advanced accounting skills?

Industries like accounting and payroll services, company management, and local government often demand advanced accounting skills due to their complex financial needs.