Key Takeaways

- Accounting offers a wide range of high-paying career paths, each with unique responsibilities and growth opportunities.

- Earning advanced degrees and certifications and building leadership skills can significantly boost your chances of landing top roles.

- Industries like finance, tech, and healthcare often pay the most, especially for professionals with strong experience and strategic insight.

Accounting has become more than just crunching numbers. Today, accountants play a key role in helping companies grow, stay compliant, and make smart business choices. With the right skills and experience, the field offers serious earning potential and room for growth.

As businesses face growing pressure to stay financially healthy and transparent, the demand for accounting experts continues to rise. Some roles stand out not only for their impact but also for the paycheck they offer. In this guide, we’ll explore some of the highest-paying accounting jobs that are making waves in 2025.

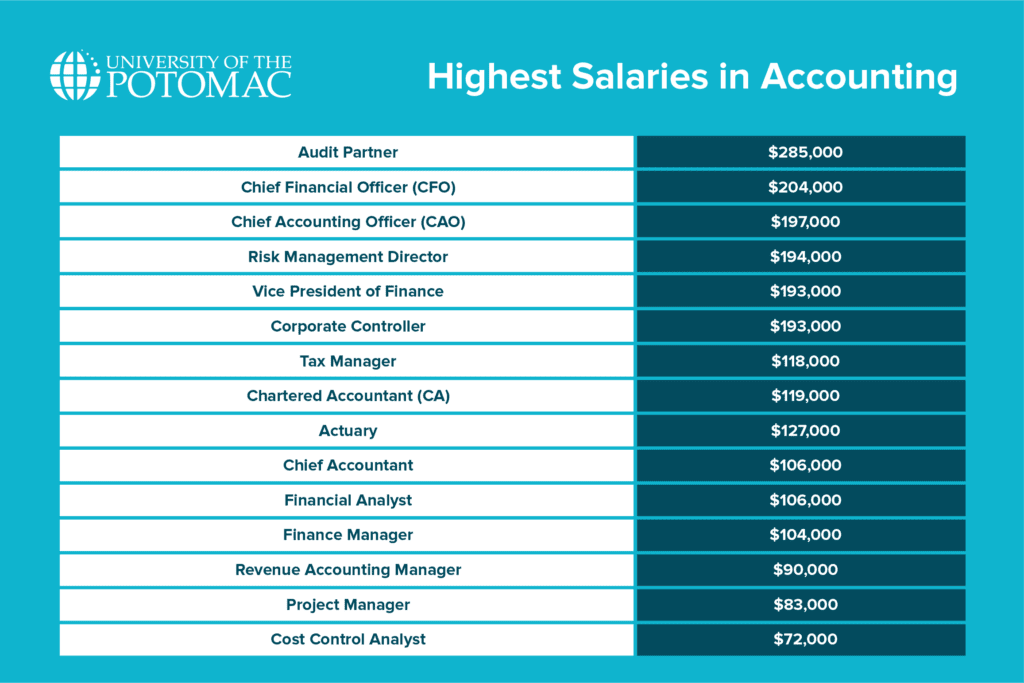

Highest Paying Accounting Jobs

Accounting opens doors to a wide variety of high-paying roles across industries like finance, healthcare, tech, and government. These jobs differ in day-to-day responsibilities, seniority levels, and areas of focus, making the field both flexible and full of opportunity.

Some positions require deep technical knowledge, while others demand leadership, strategic thinking, or specialized certifications. Each role offers its own kind of value, helping businesses stay on track and make informed decisions.

What they all have in common is strong earning potential and long-term career growth. Let’s take a closer look at the top roles leading the way in 2025.

1. Chief financial officers (CFO)

CFOs are in charge of managing long-term strategy, investments, budgets, and a company’s overall financial health. They work across nearly all industries, from startups to global corporations. As top executives, they earn some of the highest salaries in accounting.

In the U.S., average base pay hits about $204,000 annually, with compensation being influenced by company size, location, and performance bonuses. What sets this role apart is its blend of leadership, finance, and vision at the highest level of decision-making.

2. Audit partner

Audit partners lead auditing teams, ensure compliance, and guide clients through financial reporting requirements. They typically work in public accounting firms and consulting agencies. Salaries are based on years of experience, client portfolio value, and firm size.

Often found in Big Four and boutique practices, they earn around $285,000 annually. Unlike most roles, audit partners often hold equity in their firms, which significantly boosts income potential. Their ability to balance regulation with client relationships makes them stand out.

3. Vice president of finance

This role focuses on financial planning, risk analysis, and internal policy development. You’ll find VPs of Finance in industries like manufacturing, healthcare, and real estate. Their pay reflects strategic responsibility and operational oversight, earning about $193,000 per year.

While similar to CFOs, VPs usually handle more hands-on execution than boardroom leadership, offering a different path for finance professionals seeking high-level roles.

4. Chief accounting officer (CAO)

Chief accounting officers monitor all aspects of accounting, including financial reports, compliance with regulations, and the proper operation of internal systems. You’ll usually find them in big companies, especially those that are publicly traded.

What sets this role apart is the way it connects every department through accurate reporting and strong accountability. It’s a job that calls for serious expertise, and the paycheck reflects that: $197,000 average annual salary.

5. Risk management director

Risk directors work closely with teams to build smart strategies that protect a company’s finances. This role is all about spotting risks before they become problems. You’ll see them most in banking, insurance, and industries like energy where risk runs high.

Their pay reflects the pressure and precision the job requires, with an average yearly compensation of $194,000. Unlike other finance roles, this one looks ahead, not back. It’s ideal for someone who loves thinking strategically and preparing for the what-ifs.

6. Corporate controller

Controllers are the steady hands behind a company’s financial records. They ensure that everything, including payroll, reports, and more, is accurate, compliant, and completed on schedule. You’ll find them in large businesses, nonprofits, and even government offices.

What makes this role special is how it connects the people doing the numbers with the leaders making the big calls. The salary? It’s a good average of $193,000, and it reflects just how central this job is to day-to-day financial operations.

7. Tax manager

Tax managers are the go-to people when it comes to making sense of complex and ever-changing tax rules. They help businesses stay on track with local and global tax laws while also finding ways to save money legally and smartly.

This job is big in industries like real estate, finance, and international trade. It’s a job that stands out for its constant puzzle-solving, which takes sharp thinking to keep up. And yes, the paycheck definitely makes it worth it, with a $118,000 average annual income.

8. Revenue accounting manager

These managers focus on tracking and reporting income, ensuring it’s recorded correctly under current standards. They’re most common in subscription-based services, telecommunications, and tech companies.

Their salary reflects the importance of accurate revenue recognition, especially in sectors with recurring or deferred income. As of late, they receive $90,000 on a yearly basis. Precision and up-to-date knowledge make this role critical.

9. Finance manager

Finance managers help businesses make smart money decisions. They handle things like budgeting, forecasting, and keeping track of financial performance. You’ll find them working in all kinds of places, from retail to logistics to tech.

This job stands out in how it focuses on guiding the bigger financial picture, not just checking boxes. Pay depends on things like experience and leadership skills, but it’s a well-paying role for those who can think both strategically and practically, leading to a $104,000 average annual salary.

10. Actuary

Actuaries are experts in numbers who use statistics and mathematics to determine the likelihood of events such as a car accident or a medical condition. They mostly work in insurance, healthcare, and pensions. This job takes a lot of training, but the payoff is strong: $127,000 per year.

What makes it different is that actuaries rely heavily on data and prediction models rather than traditional accounting. If you enjoy problem-solving and thinking ahead, this one’s a great fit.

11. Financial analyst

Financial analysts dig into numbers to help businesses and investors make good decisions. They look at market trends, company performance, and other financial clues to spot opportunities or risks.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

You’ll find them in banks, investment firms, and corporate offices. What’s unique here is the focus on forecasting—trying to predict what’s coming next rather than just tracking what already happened. Pay can vary a lot depending on the industry, but top analysts often earn a solid income, with a $106,000 annual median wage.

12. Project manager

In finance-focused organizations, project managers oversee the budgeting, scheduling, and execution of internal financial projects. These professionals are known to work across many industries, including construction, IT, and financial services.

Salaries can be high in project management, especially for those who manage large budgets or cross-functional teams. Though the average salary is $83,000, the total pay can reach over 104,000 annually. Their blend of planning and resource management makes the role distinct from traditional accounting jobs.

13. Cost control analyst

Cost control analysts are the ones keeping budgets in check. They track where money goes, spot patterns in spending, and look for ways to do things smarter and more efficiently. You’ll often find them in fast-paced industries like manufacturing or logistics, where staying on top of costs makes a real difference.

Their work is less about big-picture strategy and more about digging into the details that save companies thousands. In this capacity, cost control analysts earn about $72,000 average annual salary.

14. Chief accountant

Chief accountants are the steady hands behind a company’s financial accuracy. They oversee the accounting staff, keep records immaculate, and guarantee timely and accurate reports.

While they might not sit at the strategy table like a CFO or CAO, their work is what allows everyone else to make confident decisions. In many ways, they’re the glue that holds the accounting department together. These experts make around $106,000 per year.

15. Chartered accountant

Chartered accountants wear many hats: they handle audits, tax planning, and financial reporting, often working in firms or running their own practice. Thanks to their international certifications, many CAs can work across countries and industries, giving them a level of flexibility most roles don’t offer.

Their deep training and broad knowledge make them go-to experts for clients and companies alike, earning them an average annual salary of $119,000.

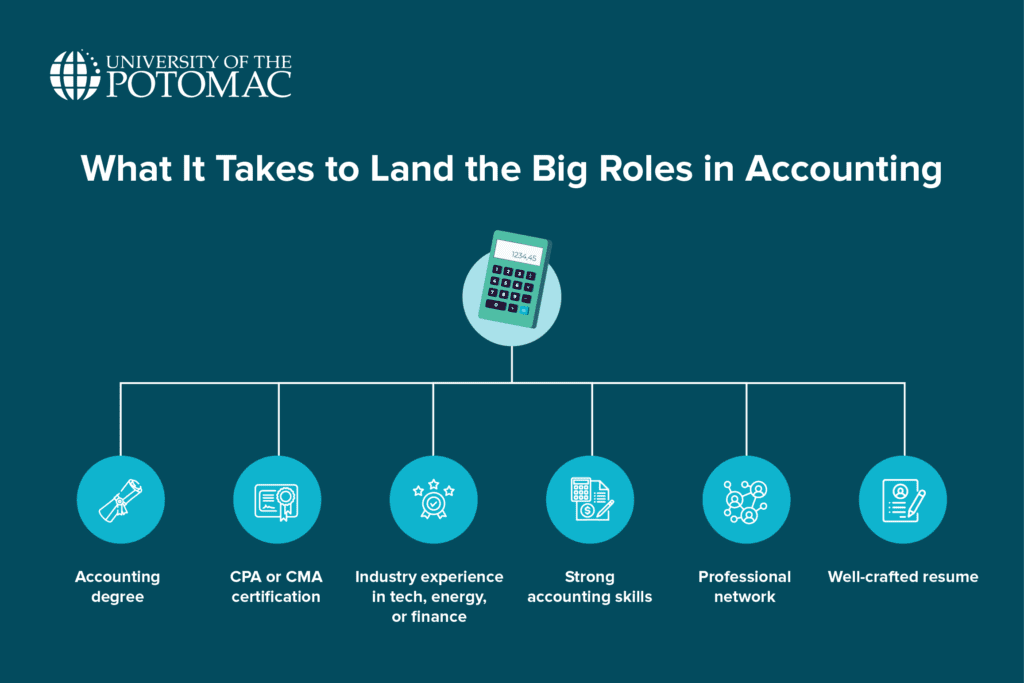

How to Land a Top-Paying Accounting Job

If you’re aiming for one of the top-paying accounting roles, your journey starts with the right education and a clear game plan. At the University of the Potomac, our business and accounting programs are built for future leaders, not just number crunchers. You’ll gain hands-on skills, learn real-world applications, and be prepared for more than just entry-level work.

Beyond a degree, consider certifications like the CPA (Certified Public Accountant) or CMA (Certified Management Accountant). These are your ticket into senior roles where strategy matters just as much as accuracy.

Experience also counts. Roles in fast-growing industries like tech, energy, or finance can move your career forward faster than traditional paths.

If you want to really stand out, then learn to lead, not just manage. Build strong communication and decision-making skills. Find a mentor, grow your network, and stay plugged into industry shifts. Employers love people who stay ahead of the curve.

Finally, polish your resume until it tells a clear story of results, not just responsibilities. And when the interview comes, be ready to talk about the big picture. Not just what you’ve done but how you think. With the right focus and the right support, like what you’ll find at the University of the Potomac, you’ll be well on your way toward success.

Conclusion

Chasing growth in your accounting career is about more than just a paycheck. It is about stepping into roles that challenge you, help you grow, and give you a seat at the table when it matters. With the right skills, mindset, and a bit of direction, those high-paying jobs are within reach.

Now is a great time to think about your next move. What kind of work excites you? Where do you want to make an impact? If you are ready to take the next step, the University of the Potomac can help. Programs like the Associate of Science in Business or the Bachelor of Science in Accounting are designed to get you closer to where you want to be.

Frequently Asked Questions

What is the highest position in accounting?

The chief financial officer (CFO) is typically the highest position, overseeing all financial operations of a company.

Which industries offer the highest salaries for accountants?

Finance, tech, and healthcare industries often offer the highest salaries for accountants, especially in corporate or senior roles.