If you have decided to pursue a business degree focusing on accounting, there is one last choice you have to make: financial accounting vs managerial accounting. Both are subdivisions of accounting and play an essential role within an organization.

To decide which one to pursue, you need to understand the basics of each branch and their similarities and differences. Let’s begin!

FREE RESOURCE

Download Our Free Guide to Jumpstarting Your Accounting Career

The latest trends, skills, and tips you need to know to fast-track your accounting career.

What Is Financial Accounting?

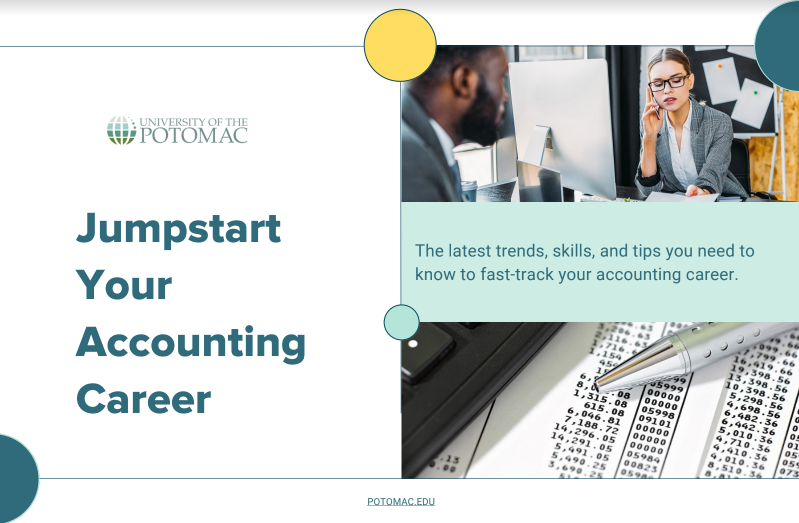

Financial accounting is one of the several accounting branches and is generally concerned with financial statements. This branch provides financial statements for a company’s external uses. These financial statements document the company’s performance and information that may interest outside parties such as investors, customers, suppliers, or creditors.

What does a financial accountant do?

A financial accountant or a financial accounting team is responsible for overseeing the economic activities within an organization. Their job is essential, as companies can make budgeting and investment decisions based on the financial accountant’s statements. In addition, financial accountants devise monthly profit/loss statements, process inventory, deal with tax reporting, prepare KPI (Key Performance Indicator) reports, examine financial records, etc.

Financial accounting career path

People who follow a financial accounting career will be able to work in various industries, including corporate and nonprofit organizations. A financial accountant’s work environment and job responsibilities depend on the type of company they work for. Some common career paths for accountants include:

- Financial analyst. Offers investment advice to clients (companies, groups, or individuals).

- Financial accountant. Prepares financial statements that interest outside parties.

- Controller. Leads accounting teams and oversees a company’s financials.

- Financial manager. Prepares financial reports and creates financial strategies for a company.

According to Glassdoor, the average annual salary for a financial accountant is $66,375.

Financial accounting skills and qualifications

Those interested in financial accounting as a career must obtain a degree in accounting or other related fields. To land a job in financial accounting, consider getting a degree in:

- Accounting or Finance

- Management

- Economics

- Mathematics

- Business Studies

As is the case in most professions, a degree is not enough to advance in accounting; you should develop a set of skills as well. A financial accountant should have excellent analytical skills as their primary duty is to analyze data. They should also have excellent negotiation and communication skills as they will always work closely with other departments. Last, but certainly not least, a financial accountant should also be detail-oriented and able to meet deadlines.

What Is Managerial Accounting?

Managerial accounting is another branch of accounting and is concerned with accounting data that aids managers in making operational decisions. To further elaborate, this branch provides financial statements for a company’s internal uses. The information supplied by managerial accounting helps the company make better decisions based on the company’s current financial state.

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

What does a managerial accountant do?

A managerial accountant is responsible for recording and processing data that will help the company perform better in terms of budgeting. The reports on risk management, budget, planning, and strategies that managerial accountants provide help the company make informed decisions in all those areas.

Managerial accounting career path

The typical career path a managerial accountant goes through begins with entry-level positions such as internal auditor, cost accountant, financial analyst, etc. As they gain relevant work experience, managerial accountants may be promoted to other positions like managing teams of auditors and analysts or becoming financial controllers. Senior managerial accountants may even aim for a CFO position.

According to Glassdoor, the average annual salary for managerial accountants is $59,332.

Managerial accounting skills and qualifications

Similar to financial accounting, managerial accountants need to have a bachelor’s degree in accounting or other related fields, as well as a unique skill set. Managerial accountants should have excellent communication skills and be able to work as part of a team. As with any accounting job, managerial accountants should have excellent analytical and numerical skills. Lastly, they should be detail-oriented and understand business fundamentals.

Financial Accounting vs Managerial Accounting: Main Differences

Though they overlap in some areas, managerial and financial accounting differ in several aspects. We will go through those aspects below.

Reporting focus

The reporting foci of financial accounting include reporting the company’s financial conditions and the end results on a particular date. In financial accounting, the reporting is focused on history, the prior year, or quarter; whereas, in management accounting, the reporting is focused on the present and future. Essentially, the main focus is to provide information in order to help management. This is done by planning, setting, and evaluating goals.

Reporting frequency

Regarding the frequency, reporting in financial accounting is done semi-annually, annually, quarterly, and yearly. In management accounting, the reporting is a lot more frequent and it can be daily, weekly, or monthly, depending on the business’ needs.

Accounting standards

In financial accounting, rules are set by specific standards like IFRS (International Financial Reporting Standards) or GAAP (Generally Accepted Accounting Principles). Companies have legal requirements to follow financial accounting standards. In contrast, management accounting is not legally required to follow specific criteria, as the reports are only used within the organization.

Tools used

Managerial and financial accountants also differ in the tools they use. Some of the tools used in management accounting are:

- Cost accounting

- Financial planning

- Statistical techniques

- Ratio analysis

- Historical cost accounting

- Management reporting

- Management information system

- Budgetary control

- Marginal costing

Some of the tools used in financial accounting are:

- Funds flow analysis

- Cash flow analysis

- Trend analysis

- Ratio analysis

- Comparative statements

- Common-size statements

Financial Accounting vs Managerial Accounting: Main Similarities

Financial and managerial accounting are similar in several areas, such as:

Use of analytics

The first similarity between financial and management accounting is that both are a part of the accounting information system. This means that the accounting information which is used in financial accounting can also be used in management accounting to disclose reports and analyses. Moreover, both of them deal with cash flows, financial statements, assets, expenses, liabilities, and revenues.

Accounting degree

In order to become a financial or management accountant, you will need at least a Bachelor’s Degree in Accounting. However, as with any other profession, you will need additional skills in order to specialize in this role. Those who seek leadership roles in either field will need to acquire a Master’s Degree in Accounting.

Reporting accounting information to users

Despite having differences in who their users are, financial accounting and management accounting have one significant similarity. Both of these fields use reports and analysis to disclose accounting information to specific users.

Final Thoughts: Which One Is Best For You?

At the end of the day, this is a question only you can answer. We recommend learning about the similarities and differences between financial accounting and managerial accounting and weighing the pros and cons. Both roles are integral to a company’s financial department, and it just depends on what you think fits you best in terms of responsibilities and opportunities.