The business and finance field is constantly expanding and in need of new professionals. Business and finance occupations are among the highest-paid ones and offer professionals several benefits.

When speaking of business administration and accounting, one can notice many similarities. In many institutions, these two specialties are in the same department. However, they display many differences that make people wonder which one is the best option to choose.

This article will guide you to a discussion on the differences between business administration degree and accounting to help you learn more about both and choose the one that best fits you.

What Is Business Administration?

Business administration is a broad specialty that encompasses a wide range of roles, professional settings, and opportunities for advancement. To put it simply, business administration is the task of managing an organization’s resources, time, and people.

A bachelor’s degree in business administration is intended to provide students with a solid academic foundation in core business functions such as general business administration, accounting, finance, project management, information technology, human resources, marketing, international business, logistics, and organizational behavior.

A frequently asked question is, “What is a better degree business administration or business management”? Business administration is a perfect choice if you want to begin an entry-level business career. However, if you want to work in management or operations or are already relatively well-established in your field, in that case, a degree in business management may be a better fit for you.

Business administration degree entry requirements

The basic entry requirements for a business administration degree include a grade point average (GPA) of at least 3.0 and a GMAT score of 600 or higher. Most of the mid-ranking schools generally require a score of 650 or higher, while more competitive business schools may require a score of 700-750.

Business administration specializations

After obtaining a degree in business administration, a wide range of specialization fields may fit you. Some of the business administration specializations include

- Financial Management

- Operations Management

- Marketing Management

- Technology Management

- Sustainability Management.

Business administration jobs and opportunities

A degree in business administration will pave the way for limitless job opportunities in numerous industries and organizational roles available in the business field. Some of the roles a business administration degree offers are:

- Procurement Officer

Procurement specialists, also known as procurement or purchasing officers, are in charge of obtaining necessary products for business operations. As one of the most important in the supply chain, this role requires analytical, organizational, and bargaining skills.

- Office Administrator

Office administrators or managers must be approachable, handle multi-task activities, phones, clients, and employees, plan and maintain office space and deal with unexpected office scenarios.

- Human Resources Manager

Human capital will always be a company’s most valuable asset. Human resource managers are responsible for workforce administration, which includes hiring, training, compliance, benefits, scheduling, retention, counseling, and strategic planning, among other things.

- Market Research Analyst

A market research analyst assists a business in determining who its customers are, what products it should sell, and how to promote those products effectively. Surveys are frequently designed by market research analysts, who also train and supervise interviewers who conduct the surveys. Afterward, they analyze the data and present the findings to management.

- Business Consultant

Business consultants, also known as management consultants, assist businesses in proposing ways to improve their efficiency. They give managers advice on making a company more profitable by lowering costs and increasing revenue. In general, management consultants arrange information about an issue, design and improvement procedure, suggest new systems and organizational changes, and confer with managers to ensure that the changes are working.

- Sales Manager

A sales manager is in charge of a company’s sales team and is responsible for revenue generation. Everyday responsibilities include establishing sales goals, evaluating sales data, and developing sales training programs for sales representatives.

Salary expectations with a business administration degree

According to the Bureau of Labor Statistics (BLS), the employment rate in business and financial operations occupations is projected to grow 8 percent from 2020 to 2030, adding about 750,800 new jobs. The annual wage for business and financial occupations was $72,250 in May 2020, higher than the median yearly wage for all occupations.

The average business administration degree salary was $69,000 per year in October 2021, according to PayScale.

What Is Accounting?

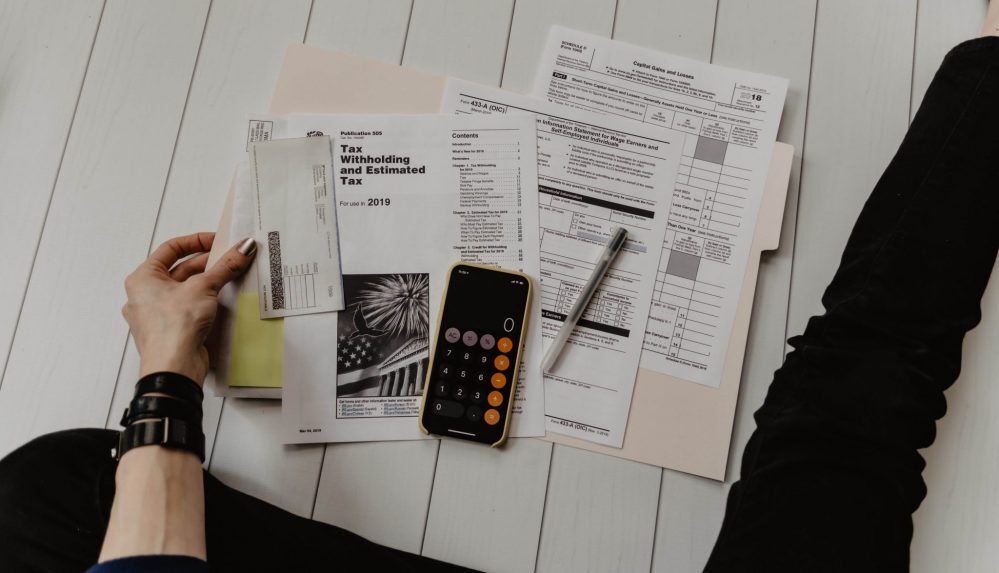

Accounting is the process of keeping track of a company’s financial transactions. The accounting department is in charge of creating a detailed and accurate financial picture of the company’s operations.

Accounting degrees are designed to teach students about financial recordkeeping for businesses, governments, organizations, and other enterprises. Corporate accounting, public accounting, and taxation are just a few of the topics covered in such programs.

A degree in accounting will teach you how to consult, handle, and advise businesses and individuals on financial matters. Accounting professionals are in high demand, so a bachelor’s degree in accounting can help you advance in your career.

Accounting degree entry requirements

Admission requirements for bachelor’s degree programs in accounting differ slightly, but all require applicants to have a high school diploma or GED. Schools typically seek students who have a 2.5 GPA or higher, with the most selective colleges requiring a high GPA as well as SAT or ACT scores.

Accounting specializations

Earning a degree in accounting will open many doors for specialization in different areas of finance. Here’s a rundown of the main areas of specialization in accountancy:

- Assurance

- Commercial finance

- Corporate finance

- Corporate treasury

- Financial accounting

- Forensic accounting

- Insolvency

- Internal audit.

Accounting jobs and opportunities

A degree in accounting translates to limitless job opportunities with a very high earning potential. Many different institutions are constantly on the look for potential employers with a degree in the field. Some of the positions you can get with an accounting degree include:

Interested in pursuing a degree?

Fill out the form and get all admission information you need regarding your chosen program.

This will only take a moment.

Message Received!

Thank you for reaching out to us. We will review your message and get right back to you within 24 hours.

If there is an urgent matter and you need to speak to someone immediately you can call at the following phone number:

- We value your privacy.

- Controller

Controllers and assistant controllers plan financial statements and reports that sum up and predict a company’s action and financial position. They also develop internal policies and practices for budget administration, cash and credit management, and accounting functions for an organization or company.

- Financial Manager

Financial managers are in charge of an organization’s financial health. They create financial reports and devise strategies to assist their organization in meeting its long-term financial objectives.

- Management Consultant

Management consultants, also known as management analysts, make recommendations for improving operational efficiencies in order to make institutions more profitable through lower costs and increased profits.

- Personal Financial Advisor

Financial advisors assist their clients in understanding their financial situation and making personal investment choices. They keep track of their clients’ investments and finances and can advise them on insurance, mortgages, college savings, estate planning, taxes, and retirement.

- Financial Analyst

Financial analysts examine the financial data of a company. They also guide businesses in making investment decisions and forecasting for the future by analyzing past financial and investment data and estimating future income and costs.

- Accounting Manager

Accounting managers are in charge of the accounting department of a company. They analyze and report financial data, assist with tax preparation, and prepare financial statements for the company’s board of directors.

- Budget Analyst

Budget analysts assist businesses in organizing their finances, preparing budget reports, and monitoring institutional spending. They regularly review an organization’s financial plans to ensure completeness, accuracy, and compliance with regulations and organizational objectives.

- Credit Analyst

These financial professionals evaluate and assess financial data from sources such as reporting services, credit bureaus, and bank branches in order to determine the viability of loan requests and approve or deny loan applications.

- Accountant

Accountants are primarily responsible for preparing, maintaining, and auditing an organization’s financial statements. They ensure that all financial records, such as balance sheets, income, and loss statements, cash flow statements, and tax returns, comply with federal laws, regulations, and generally accepted accounting principles (GAAP). They must also identify and resolve any discrepancies in records, statements, or documented transactions.

Salary expectations with a degree in accounting

According to the Bureau of Labor Statistics (BLS), the employment rate for auditors and accountants is projected to grow by 7 percent from 2020 to 2030, about as fast as the average for all occupations. About 135,000 openings for accountants and auditors are launched every year, on average, over the decade.

The median annual wage for accountants and auditors was $73,560 in May 2020. The lowest 10 percent earned less than $45,220, and the highest 10 percent earned more than $128,680.

The Difference Between Business Administration and Accounting

While similar in many ways, accounting and business administration have distinct characteristics and even overlap in the job market. The main difference between business administration and accounting is the major’s primary focus. Accounting is solely concerned with financial matters. It deals directly with bookkeeping, taxation, and accounting, whereas business administration is more concerned with strategic financial planning.

When it comes to the accounting vs. business administration situation, we cannot pick a winner. Business administration and accounting are profitable fields that will lead you to great job opportunities and countless chances for specialization in different business and finance areas.

In this case, the answer to which one is preferable is totally subjective. It all depends on what are your preferences and plans for the future. Furthermore, as they’re so similar in many aspects, it is easy to switch careers in the middle and not make a mistake with either one.